How Top Investors Compound: Lessons from Hayden Capital & Seth Klarman

Welcome to The Smart Portfolio, where each week, we share ultra-wealthy strategies, high-earner survey data, and real investment case studies.

In this issue:

Hayden Capital’s playbook to compound returns: invest in businesses and stop trading

Seth Klarman’s rules for beating the market

1. Ideas you should steal from institutional investors

Podcast: Capital Allocators with Ted Seides, Ep. 458: Alt Goes Mainstream (Sept. 8, 2025)

In this podcast episode, Ted Seides explains what individuals and advisors can borrow from institutional investing, what to expect from private equity, how to think about manager selection, and how to avoid behavioral mistakes that quietly tax returns.

Start with first principles, not products: Endowments begin with goals, time horizon, and risk, then work backward into a simple plan. For most investors that means an equity tilt, broad diversification, and rules to rebalance. You can get most of this through low-cost index funds and ETFs. Example: a 70/30 stock-bond mix with set bands that trigger rebalancing quarterly keeps risk in check without guessing the market.

Private markets - diversify first, chase alpha second: Private equity and credit can add exposures that public markets miss, especially as the public universe has shrunk. The catch is: fees and manager dispersion. The median private equity fund may not beat a low-cost S&P 500 index after all-in fees. Returns cluster in the top quartile, which is hard to access and identify. Treat private markets as a diversification tool unless you have real access and diligence depth. Example: size a core private equity allocation at 5-15% for diversification, not 30% banking on outperformance.

The honest math on the PE vs S&P question: Will average US buyout funds beat the S&P 500 after fees over time? Ted Seides’ view: maybe a 40% chance. Leverage, small-company tilt, and control can help, but fees are heavy and entry multiples matter. If you cannot underwrite top-quartile managers, expect “beta-like” private market returns with less liquidity and higher fees. So size these bets accordingly.

How to look for real edge: Use BAIT: Behavioral, Analytical, Informational, Technical. In practice, you’re looking for consistent process, sector focus that actually fits the edge, and evidence in deal selection and value creation levers. Ask plain questions: What exactly do you do better than peers? Where in the deal lifecycle do you create value: sourcing, price, operations, or exit? Request case studies with numbers, not adjectives.

Beat your own biases with process: The default human setting is to make fast, confident, and often wrong decisions. Create structure: write pre-mortems, record reasons for each allocation, and have the final decision maker speak last. Revisit decisions against outcomes. Do not let pacing pressure, hot vintages, or glossy decks rush you.

Bottom line

Do the simple things right, be ruthless on fees and process, and use private markets to round out the map rather than as a silver bullet. The edge is scarce and difficult to bet on, so count more on discipline instead.

2. Hayden Capital’s playbook to compound returns: invest in businesses and stop trading

Source: Hayden Capital’s 2Q 2025 investor letter (Sept. 24, 2025)

Stomach Volatility, Win With Time

Hayden’s core point is that you win by surviving. In game theory terms, use a “minimax” mindset: optimize so that even your worst realistic outcome does not knock you out. In investing that means right-sizing positions, holding enough cash or short-duration ballast for liquidity needs, and avoiding leverage that forces selling at the bottom. A steady 10% for 30 years beats 30% for 10 years if year 11 forces you out.

Invest In Businesses, Not the Tape

The letter contrasts two games. Business ownership is an infinite game where profits are the “toll” on real value created. Short-term trading is zero-sum and capacity constrained.

Owning a business: You make money by creating value for customers. If customers are happy, they pay you. Profits are the proof. Think of profits as a small toll you collect each time you solve a real problem.

Short-term trading: You try to guess where a price will move in the next day or week. Your gain is usually someone else’s loss. It is crowded, fast, and your edge often shrinks as more money does the same thing.

Why business ownership compounds value

When you own a good business, cash flows can grow for years. The company finds new customers, raises prices a bit, launches a new product, or expands to new markets. Each dollar of profit can be reinvested to earn more dollars next year. That is compounding.

Why short-term trading struggles to scale

Trading edges are fragile and capacity constrained. If you find a pattern that works with $100K, it may stop working at $100M. Costs, slippage, and crowds eat your edge. You must keep being right again and again, on short time frames, with little room for error.

How to spot the compounding game

Use a simple checklist:

Moat: Do customers come back because of switching costs, network effects, brand, or cost advantage

Runway: Can the business reinvest large chunks of profit at high returns for years

Cash discipline: Does management reinvest wisely and avoid empire building

Alignment: Do insiders own stock and act like owners

Resilience: Can the firm handle a rough year without new capital or desperate moves

What to ignore:

One quarter of noisy results

Headlines that do not change long-term cash generation

Hype about total addressable market without proof of unit economics

3. Seth Klarman’s rules for beating the market

Podcast: Value Investing with Legends, Season 11 - Ep. 2: Seth Klarman - Contrarian Investing, Discipline, and Building Baupost (Aug. 1, 2025)

Baupost’s Seth Klarman lays out how he actually makes money: look where others aren’t, buy at a discount with a clear downside plan, and be patient enough to wait for fat pitches.

Why markets stay beatable

Humans swing between fear and greed.

Big investors accept constraints that create forced buyers and sellers. Think index adds/drops or “we only own investment grade.” When something falls outside the box, price can disconnect from value.

Takeaway: build a hunting list of places where constraints create mispricing, not just a list of “cheap” tickers.

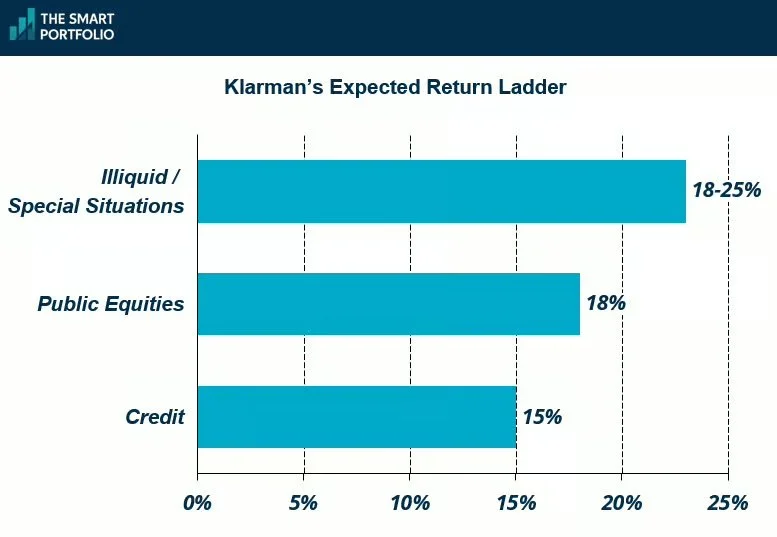

Klarman’s rule of thumb for returns

Klarman’s rule is to target roughly 15%+ returns for credit, higher teens for public equities, and high teens to mid 20s for illiquid bets to compensate for lockups. If you can’t underwrite these returns with conservative assumptions and a margin of safety, pass.

Generalist first, specialist second

Baupost runs “a mile wide, then a mile deep.” Stay flexible so you can react when a complex or off-the-run asset must be sold by Friday. Once you choose a target, go deep like a specialist to truly know the downside and the catalysts.

Management and incentives matter

Balance sheets aren’t enough. Ask management, plainly: why should anyone buy the stock here, and how will shareholders get paid? Your job is to judge their judgment. If the answer is fuzzy, move on.

Where he sees opportunity now

He rates the current opportunity set a 4/10. Credit tightened and feels less attractive. Select equities work, but the majority of the bets are already crowded.

The area with the most interest today: commercial real estate, where sellers are finally meeting the market and capital structures are moving again.

Also, macro risks aren’t trivial: large deficits, policy whiplash, and geopolitical shocks can matter.

Bottom line

Patience, price, and process win more often than predictions. You don’t need to outsmart the market daily. You need a repeatable filter: only buy discounts you can explain, only with a clear downside plan, and only when you are being paid enough for the risk and the wait.

Disclaimer

This newsletter is for informational and educational purposes only and should not be construed as personalized financial, tax, legal, or investment advice. The strategies and opinions discussed may not be suitable for your individual circumstances. Always consult a qualified financial advisor, tax professional, or attorney before making any decisions that could affect your finances. While we strive for accuracy, we make no representations or warranties about the completeness or reliability of the information provided. Past performance is not indicative of future results. All investments involve risk, including the possible loss of principal. The publisher, authors, and affiliated parties expressly disclaim any liability for actions taken or not taken based on the contents of this publication.