Who You Ask Determines the Portfolio You Get

New research shows portfolio advice varies wildly depending on who you ask — professionals, peers, or AI. We explore what that means for advisors, why marketing must be treated like an investment, and how client experience will define the next decade of wealth management.

85% of Clients Thought About Leaving Their Advisor Last Year

A new Hartford study shows loyalty is thinner than most advisors think. This week, we break down how to retain clients through better experience, meet rising demand for private markets, and build a referral engine that actually scales.

The Real Growth Engine for Advisors in 2026

LPL’s data shows planning-led advisors are growing faster, trust matters more than performance, and the automation age is reshaping where real opportunity lies, for portfolios and for advisory firms.

Your Clients Think They’re Diversified, They’re Not

Markets are more concentrated than they appear, 2026 looks volatile, and client trust is fragile. This week, we share how top investors are positioning, where passive portfolios hide risk, and how better communication protects relationships when it matters most.

You Can’t Ignore Alternatives. But You Can Get Them Wrong.

Alternatives are becoming unavoidable, but the risks are easy to misjudge. This week, we break down how advisors can navigate alternatives intelligently, what family offices get right about downside protection, and how BlackRock is positioning portfolios for the AI era.

Before You Add Alternatives, Read This

Alternatives are becoming essential — but only if you understand the risks beneath the returns. This week, we break down what advisors must know before allocating, where private markets truly add value, and how to find the rare stocks that actually compound wealth.

IRRs Are Lying to You: Here’s How to Compare Risk the Right Way

Headline IRRs hide more than they reveal. This week, we unpack what advisors must understand before adding alternatives, why private markets are becoming essential, and how to identify the 1% of stocks that truly compound wealth.

Why Alternatives Are Now Mandatory, Not Optional

JP Morgan’s long-term outlook is clear: traditional portfolios won’t deliver without meaningful alternative exposure. This week, we break down preferred-equity private credit, PE’s new playbook, and why steady consistency still beats chasing winners.

Why Middle-Market PE Is the Only Real Alpha Left

Mega-cap buyouts are crowded and over-levered — future returns will come from hands-on operational value. This week, we break down why the middle market is where real alpha lives and how advisors should position clients.

How Top Advisors Pitch Alternatives (and Win Bigger Clients)

Learn the HDMA framework, how billionaires think about deal structure, and why oil & gas incentives are becoming a go-to tax strategy for high-income clients.

The AI Bubble, The 85% Drawdown, and The Myth of Experience

How to position for AI's immediate profit pools; the truth about position sizing; and why most investors are diversifying ignorance.

Rethinking Safety: What Ben Graham Would Buy Today

Ben Graham’s margin of safety was built for factories and balance sheets - not brands, networks, and code. This week, we explore how today’s best investors apply his timeless principle to modern growth companies.

The Three Big Shifts Every Wealth Manager Should Be Watching

From market timing myths to private credit’s rise and the U.S.–China rivalry shaping global portfolios, here are the three shifts redefining how wealth is built and protected in 2025.

Jim Grant, Bill Ackman, and the Bubbles No One Wants to See

Jim Grant warns of euphoria, Bill Ackman preaches humility, and private markets look frothy. In this week’s issue, we unpack what smart investors are doing when confidence runs high — and caution whispers louder.

How Top Investors Compound: Lessons from Hayden Capital & Seth Klarman

Hayden Capital’s playbook for long-term compounding, Seth Klarman’s rules for beating the market, and what individuals can learn from institutional investors.

From Offense to Defense: What Lynch, Dalio & Marks Are Saying Now

Lynch says know what you own. Dalio warns of dark cycles. Marks advises leaning defensive. Here’s what it means for your portfolio.

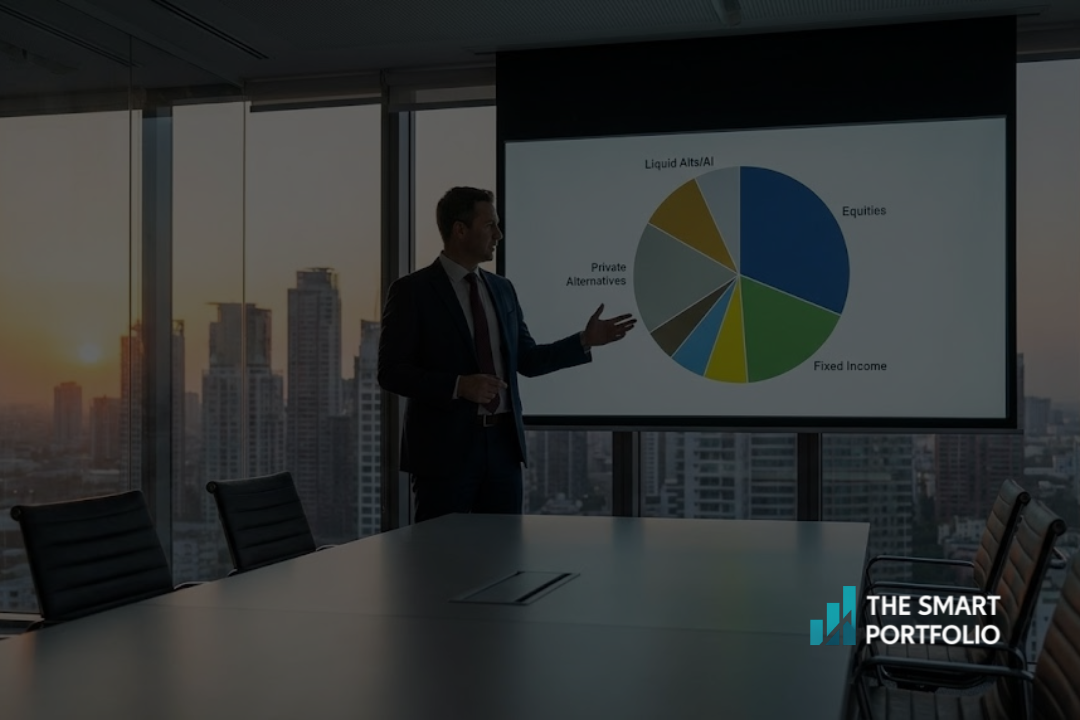

How the Wealthy Invest, Why 60/40 Is Dead, and Finding Your Perfect Mix

Inside: lessons from family offices, why many investors should go 85/15 instead of 60/40, and how to find the stock-bond balance that actually fits your goals.

Why Many Investors Lag, What Millionaires Regret, and How to Choose the Right Hedge Fund

This issue unpacks why investors trail market returns, the top regrets of retired millionaires, and the trade-offs between multi- and single-manager hedge funds.

Are you tracking your balance sheet—or flying blind?

Most high earners focus on income, but miss the real driver of wealth: what your assets and liabilities do between paychecks. Our latest issue shows how missing pieces in your balance sheet can cost millions—and how to fix it.