85% of Clients Thought About Leaving Their Advisor Last Year

Learn AI from the experts building the future of wealth management. Reply “Skills” to save your spot as a Founding Member (first 100 get 50% lifetime discount).

In this issue:

A Hartford study found 85% of clients considered switching advisors last year – what can you do about it?

iCapital’s investment strategist on why investors increasingly want access to the private markets

Scaling through referrals: recognize your best clients to create competitive energy among them

1. A Hartford study found 85% of clients considered switching advisors last year – what can you do about it?

The Efficient Advisor podcast with Libby Greiwe: The 85% Wake-Up Call Every Advisor Needs to Hear (Feb 6, 2026)

TLDR:

85% of clients thought about switching advisors in the past 12 months according to a recent Hartford Funds study.

Most advisors overestimate the impact of their services. Activities like detailed newsletters may matter less than they think.

The solution involves auditing your client experience for genuine impact, reducing friction, and consistently re-demonstrating your value.

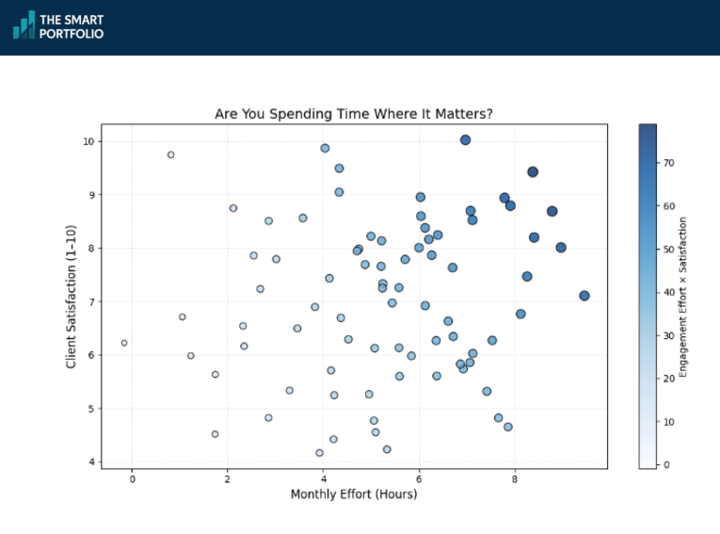

Are you doing work that matters to clients?

Greiwe shared an example from her coaching practice: an advisor spending 3-5 hours monthly writing detailed market newsletters. When she analyzed engagement – open rates, time spent reading, video completion – the data told a different story. At 50-60 hours annually, that's two full weeks of work with questionable return.

The same principle applied to her own practice. She had been updating MoneyGuide Pro plans annually for every client, a heavy lift requiring extensive data gathering. But she realized that unless someone experienced a major life change, the plans barely moved year over year. She reallocated that time to higher-impact activities.

Move clients across the "invisible bridge"

New clients arrive excited but nervous. Previous advisors may have planted doubt. Buyer's remorse kicks in quickly. Greiwe argues the first 100 days are critical for moving clients from "I hope I made the right call" to "I'm so glad I did this."

Research supports this: client experience in the first 100 days directly affects relationship longevity, lifetime value, and referral likelihood. Every touchpoint should be designed to deepen the relationship, and not just execute paperwork or distributions.

Think like Uber, not a taxi

Greiwe uses the Uber vs. taxi comparison. Uber succeeded by identifying every friction point in the taxi experience and eliminating it: no cash needed, see driver location, automatic receipts, easy rating system.

Advisors should audit their own processes the same way. Where are clients experiencing unnecessary friction? What feels cumbersome that could be streamlined?

She also emphasizes regularly re-onboarding existing clients. Let them know your current ideal client, your full service offerings, and what working with you looks like now, not five years ago. Clients who say "I trust you, we don't need to meet" may actually be disengaging, not showing confidence.

The bottom line

If 85% of clients are considering alternatives, the opportunity cuts both ways. Other advisors' clients may be looking for you. But winning them requires a buttoned-up process focused on genuine impact, smooth client experience, and consistent value demonstration.

2. iCapital’s investment strategist on why investors increasingly want access to the private markets

The Master Investor Podcast with Wilfred Frost, “This is the Era of the Retail Trader": Sonali Basak on Democratising Private Markets (Feb 5, 2026)

TLDR:

Minimums for private market investments have dropped from $10 million to as low as $25,000

Younger generations actually view private markets as less risky than public markets because they missed SpaceX and OpenAI growth

Responsible democratization requires giving individual investors the same transparency institutions receive

Sonali Basak left Bloomberg to become chief investment strategist at iCapital, a platform standing at the intersection of public and private markets.

The access revolution

Investment minimums that once required $10 million, then $1 million, are now dropping to $25,000 or lower. Exchange-traded products, evergreen structures, and new fund formats are making private markets accessible to a much broader investor base.

This shift is being driven by necessity. Net new flows into private markets are increasingly coming from the wealth channel rather than institutions. Many endowments can't invest in venture right now because they're overweight private markets, and tax headwinds are affecting their capacity.

A generational mindset shift

Basak's research found that millennials and younger generations are more likely to invest in private markets and actually perceive them as less risky than public markets.

Why? These generations are accustomed to the SpaceXs and OpenAIs of the world. They missed the growth of companies that stayed private through massive value creation phases. That's frustrating, and they want access.

The responsibility challenge

Basak emphasizes that democratization must happen responsibly. Individual investors deserve the same transparency and education that institutions receive.

The calculus for building wealth has fundamentally changed. You used to be able to buy a house and build wealth over decades. Today, that's far less certain. The equity market has become the primary wealth-building mechanism for many people, which explains why other assets get sold while equities hold up.

What advisors should communicate

Structured products tied to major stocks and indexes, alongside private market funds, give clients exposure to parts of the financial system that were previously inaccessible. But advisors must ensure clients understand liquidity constraints, fee structures, and the different risk profiles of these investments.

The bottom line

The financial system has fundamentally changed since 2008, with non-bank players filling roles once held by traditional banks. Advisors who understand this shift – and can explain it clearly to clients – will be better positioned to serve investors who increasingly want access to private markets.

3. Scaling through referrals: recognize your best clients to create competitive energy among them

The Advisor Journey podcast, Scaling Through Trust: Yohance Harrison on Referrals, Relationships, and Sustainable Growth (Jan 8, 2026)

TLDR:

Identify your "kings and queens" – clients who've referred three or more people who became clients – and publicly recognize them

Run a systematic email sequence that asks every client for referrals at least once per year, with automated follow-up

Referrals scale when you have a process that runs without your constant involvement

Identify and celebrate your kings and queens

Harrison defines "kings and queens" as clients who've referred three or more people who actually became clients – not just names, but converted relationships. He identifies them through his CRM (Wealthbox), tracking the source of every client.

The secret sauce: he tells these clients publicly that they're his referral royalty. At client appreciation events or even personal gatherings like birthday parties, he'll make a toast acknowledging specific people: "You introduced me to so-and-so." This creates competitive energy. Harrison describes two queens racing to introduce him to people at a wedding because they wanted to "claim" those referrals.

The psychology works because most people enjoy helping others. Harrison learned to simply ask: "I need to get a little uncomfortable… can I ask you for help?" When clients say yes, he follows with his specific request. This approach turned one ER doctor client into an entry point for an entire physician network when she invited him to speak at a women in medicine breakfast.

The automated referral email system

Every client receives an email after key meetings (like financial plan presentations) thanking them and asking them to introduce someone who might benefit from financial planning. This runs systematically; at least once per year for every client.

When a referral comes in, Harrison's assistant enters the name into their CRM and runs a three-touch outreach sequence inviting them to a discovery session. If no response after three attempts, they email back the referrer: "Hey, we haven't heard from Matt. Maybe he's not interested?"

What happens next is powerful: the original client often texts Matt directly ("Don't waste my advisor's time"), or feels guilty and finds someone else to refer. Either way, the system creates accountability without being pushy.

Unresponsive referrals go into continuous marketing. 6,000 people in Harrison's database receive ongoing communications. Some convert years later when circumstances change.

Use AI to stay sharp in client meetings

Harrison added an AI notetaker with a custom prompt that lists any referrals from each client over the past six months. This surfaces dropped balls in real-time. During a meeting, he might say: "Thanks for referring Matt three months ago – we haven't been able to reach him. Is this still a good email?" Often the client will text Matt right there or create a group chat introduction.

The bottom line

Referrals scale when you stop treating them as random and start treating them as process. Harrison's system runs with minimal intervention: automated emails, systematic follow-up, CRM tracking, and public recognition that creates positive competitive energy among your best clients.

Disclaimer

This newsletter is for informational and educational purposes only and should not be construed as personalized financial, tax, legal, or investment advice. The strategies and opinions discussed may not be suitable for your individual circumstances. Always consult a qualified financial advisor, tax professional, or attorney before making any decisions that could affect your finances. While we strive for accuracy, we make no representations or warranties about the completeness or reliability of the information provided. Past performance is not indicative of future results. All investments involve risk, including the possible loss of principal. The publisher, authors, and affiliated parties expressly disclaim any liability for actions taken or not taken based on the contents of this publication.