The Real Growth Engine for Advisors in 2026

Learn AI from the experts building the future of wealth management. Reply “Skills” to save your spot as a Founding Member (first 100 get 50% lifetime discount).

In this issue:

LPL says fee-for-service financial planning is the growth engine for 2026

Why chasing maximum returns for clients often backfires

We’re in the early innings of a fundamental economic transformation: from the information age to the automation age

1. LPL says fee-for-service financial planning is the growth engine for 2026

The Elite Financial Advisor podcast: The Advisor Shift Is Here: How Planning, EQ, and AI Are Changing the Industry with Adam Correa (Jan 30, 2026)

TLDR:

Advisors who actively offer financial planning are growing at 3x the rate of their peers at LPL.

High-net-worth clients now expect comprehensive planning. Those who go "upmarket" and charge planning fees are seeing 10x business growth.

The biggest barrier isn't client demand. It's advisor "head trash" about charging for their time and expertise

Adam Correa, VP of Financial Planning at LPL Financial, oversees planning resources for nearly 30,000 advisors. His team conducted over 2,000 one-on-one coaching sessions with advisors last year.

The movable middle is where the opportunity lives

Correa describes three types of advisors:

Those content with their current practice

Those resistant to change, and

The "movable middle": advisors who want to evolve but haven't figured out how. That middle group is the largest, and it's exactly where the opportunity sits.

The resistance usually comes from what Correa calls "head trash" – limiting beliefs like "clients won't pay for planning" or "charging a fee will kill my AUM opportunity."

The data says otherwise. LPL's active financial planners don't cannibalize their advisory business; they jumpstart it. Clients who go through a planning process first become more engaged, more trusting, and more likely to consolidate assets.

Why positioning beats selling

The shift requires reframing how you talk to prospects. When a new client slides an investment statement across the table and says "I had a bad year – can you help?" the instinct is to respond directly. Correa suggests a different approach: push that statement aside and ask, "Tell me what's important about money to you."

That question opens a planning conversation instead of a product pitch. It's a small change in positioning that transforms the relationship from transactional to consultative.

As Correa puts it: "Every time I meet with my advisor, he makes me feel better about my plan" is a fundamentally different client experience than "every time he calls, he wants me to invest more money."

Optionality wins clients

One of the most practical tactics Correa recommends: give clients options for how to work with you.

For a business owner with cash flow going back into their company but limited liquidity, a planning engagement might make more sense than AUM management, at least initially. That optionality makes you more approachable than competitors with $2 million minimums.

The planning engagement also serves as a screening mechanism. If a prospect goes through your process and doesn't engage? You've saved yourself a headache and gotten paid for your time.

The bottom line

Edward Jones just approved fee-for-service planning. LPL is investing heavily in planning resources and technology. The industry has chosen a direction. The advisors who learn to communicate planning as a standalone value proposition – and build efficient systems to deliver it – will capture the growth. Everyone else will be competing for a shrinking slice of transactional business.

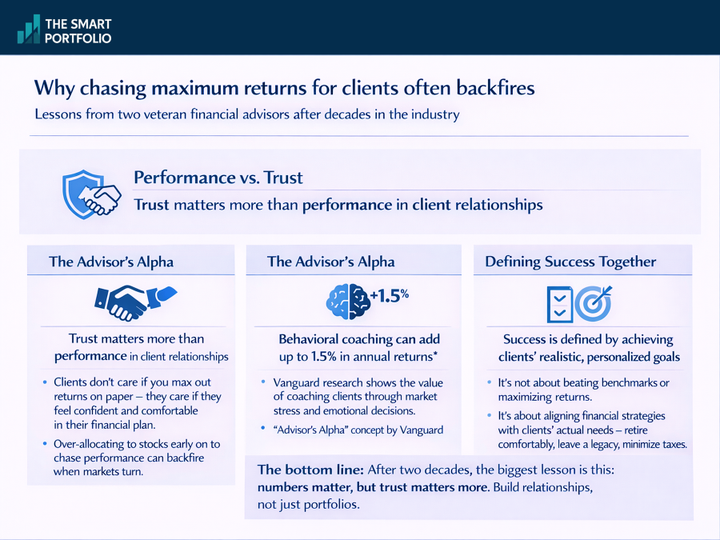

2. Why chasing maximum returns for clients often backfires

GDS Unplugged podcast: 20 Years as a Financial Advisor - Lessons Learned Along the Way (Jan 28, 2026)

TLDR:

Trust matters more than performance when building lasting client relationships

Early-career advisors often make the mistake of over-allocating to stocks to maximize returns rather than matching client comfort

Behavioral coaching can add up to 1.5% in annual returns according to Vanguard research

Two veteran advisors – Glen Smith and Robert Casey – with over 20 years of combined experience reflect on what they wish they'd known when starting out.

The performance trap that costs you clients

Early in his career, one advisor focused intensely on maximizing client returns. If someone was 65 and wouldn't need their money for five years, he'd push toward heavier stock allocations. His logic was simple: more time equals more risk tolerance equals better returns.

The problem? He was treating clients the way he'd want to be treated rather than how they actually needed to be treated. When markets dropped, clients who were technically "fine" on paper panicked anyway. That's because risk tolerance on a questionnaire rarely matches risk tolerance when your portfolio drops 30%.

Why a 3% bump might come from behavior, not performance

Vanguard published research suggesting that working with a financial advisor can add approximately 3% in value annually. Here's the surprising part: roughly half of that value (about 1.5%) comes from behavioral coaching alone.

This means keeping clients from making emotional decisions during market turbulence, like selling near the bottom or chasing hot investments, can be worth more than stock picking or asset allocation tweaks.

Most investors don't earn the average return of the funds they hold because they get in and out at the wrong times.

Measuring success differently

When asked how to measure success in a financial plan, the answer isn’t about beating benchmarks. Success means getting on the same page with clients about realistic goals, then achieving those goals.

For some clients, success is generating enough cash flow to retire comfortably. For others, it's leaving a specific amount to grandchildren or minimizing lifetime taxes through Roth conversions.

The key is having tough conversations early about what's actually achievable. If someone has $3 million and expects to withdraw $300,000 annually forever, no advisor can make that math work sustainably.

The bottom line

After two decades, the biggest lesson is this: numbers matter, but trust matters more. Performance is important, but a client who trusts you through market downturns will stay. One who was promised maximum returns and got scared during a correction will leave. Build relationships, not just portfolios.

3. We’re in the early innings of a fundamental economic transformation: from the information age to the automation age

The Bull of Wall Street podcast: Scott Helfstein, Global X Global (Jan 26, 2026)

TLDR:

We've shifted from the "information age" (1995-2020) to the "automation age" where technology makes decisions, not just informs them.

Traditional sectors like utilities and industrials have doubled their profit margins over five years. Real economic breadth is happening even if market breadth isn't.

Scott Helfstein, Global Head of Investments at Global X, uses a simple framework: the information age gave us technology to inform decisions; the automation age gives us technology that makes decisions or takes actions.

Why this matters beyond the mag-7

The mag-7 concentration gets all the attention, but Helfstein points to something many advisors are missing: an economic broadening that's already underway.

Utilities now run 13% profit margins – double what they achieved a decade ago. Industrials and materials are seeing similar profitability gains.

Why? These "boring" sectors are adopting technology and driving efficiency in ways that weren't possible five years ago.

Insurance companies now send drones to inspect roofs instead of people. Manufacturing facilities use collaborative robots powered by AI. These productivity gains are showing up in margins.

The AI investment isn't like the dot-com bubble

When clients ask whether AI spending resembles the circular investing of 2008 (banks trading mortgage assets back and forth), Helfstein offers a key distinction: the underlying asset matters. In 2008, the asset was housing, which has essentially flat cash flows. Today's AI investments are focused on rapidly growing revenues and earnings.

Yes, Microsoft invests in OpenAI, and OpenAI spends that money on Azure. But if that spending opens $20-25 billion in enterprise AI market opportunity, the circular math works out very differently than housing ever could.

Where the opportunities hide

Helfstein identifies several underappreciated areas:

defense technology (with potential defense budgets rising 50%+),

copper miners (three major mines have reduced production while data center demand surges), and

US infrastructure companies (domestic revenue means no tariff exposure).

His contrarian view: stop waiting for market breadth. It may not come because everyone already owns the mag-7 everywhere. Focus instead on the economic breadth that's already delivering higher margins across traditional sectors.

The bottom line

The shift from information to automation represents the biggest economic transformation since the 1920s. Advisors should look beyond the obvious AI plays to traditional sectors capturing productivity gains: utilities, industrials, and materials are posting record margins that the market hasn't fully priced in.

Disclaimer

This newsletter is for informational and educational purposes only and should not be construed as personalized financial, tax, legal, or investment advice. The strategies and opinions discussed may not be suitable for your individual circumstances. Always consult a qualified financial advisor, tax professional, or attorney before making any decisions that could affect your finances. While we strive for accuracy, we make no representations or warranties about the completeness or reliability of the information provided. Past performance is not indicative of future results. All investments involve risk, including the possible loss of principal. The publisher, authors, and affiliated parties expressly disclaim any liability for actions taken or not taken based on the contents of this publication.