How Top Advisors Pitch Alternatives (and Win Bigger Clients)

Got a private deal on your desk? Get a deal profile for free.

If you’re evaluating a private deal and the sponsor has a DCF, we’ll turn it into a Deal Profile that shows: IRR range, “how it would perform during the Great Financial Crisis,” factor exposures, and portfolio fit. We use the sponsor’s model as-is - don’t endorse or rate the deal - and give you something to discuss with clients. If interested, email kp@thesmartportfolio.com

In this issue:

How to pitch alternatives to clients

Investing like family offices: why billionaires obsess over deal structure

Oil & gas deals for high-income tax breaks

1. How to pitch alternatives to clients

The Retirement Roadmap podcast by SHP Financial, Episode: The Emergence of Private Equity, Private Credit & Alternatives with Jon Diorio, Head of Alts for Wealth at BlackRock (Nov. 26, 2025)

TLDR:

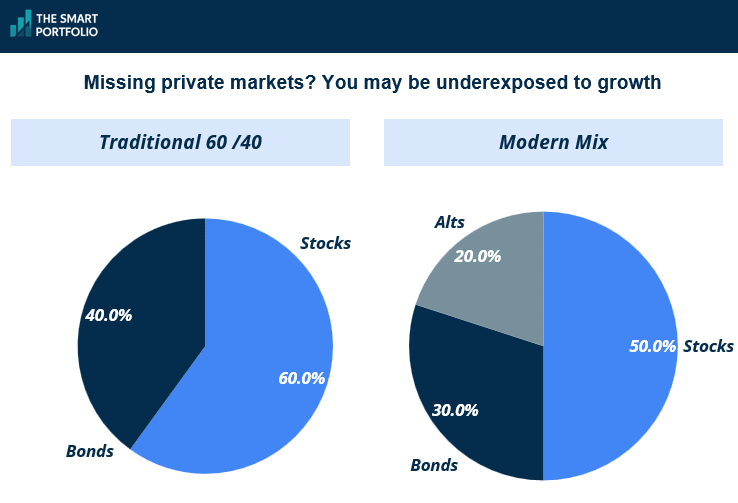

Public markets are shrinking (-30% companies) while private markets are growing, meaning 60/40 portfolios may be missing a big chunk of the economy.

The "HDMA" framework (Hedge, Diversify, Modify, Amplify) to clearly explain the specific role of an alternative asset to a client.

"Evergreen" structures have democratized access, allowing accredited investors to access private markets.

The "Shrinking" Public Market Problem

The S&P 500 is supposed to represent "the economy" but that's becoming less true every year. Over the last 30 years, the number of public companies has dropped by 30%, while the number of private companies has grown by the same amount.

Companies stay private longer because they can get funding easily without the hassle of going public. For example, 80% of companies with over $100 million in revenue are private!

If wealth advisors only use public equities to construct investment portfolios, they are effectively ignoring a massive, high-growth segment of the US economy.

The HDMA Framework

When introducing alternatives, the HDMA framework can simplify the conversation by focusing on the outcome the client wants:

Hedge: Strategies that are uncorrelated or negatively correlated to stocks (e.g., certain hedge funds). You use this to protect against market drops.

Diversify: Strategies that generate returns but don't move in lockstep with the S&P 500 (e.g., low-correlation global macro). This smooths out the ride.

Modify: Tools that change the return profile of an existing asset class, such as buffered ETFs or option-writing strategies that trade upside for income or protection.

Amplify: Strategies designed to boost returns or yield, such as Private Equity (amplify returns) or Private Credit (amplify income).

Asking a client, "Are we looking to Modify your risk or Amplify your income?" is a much better starting point than "Do you want private credit?".

The Rise of "Evergreen" Funds

Historically, private markets were a headache for advisors: high minimums ($250k+), complex capital calls, and the dreaded K-1 tax forms.

The industry is now shifting toward "semi-liquid evergreen" funds (Introduction to Evergreen Funds by Hamilton Lane). These allow for monthly subscriptions, lower minimums (often accessible to Accredited Investors rather than just Qualified Purchasers), and simpler tax reporting.

Think of them as "wrappers" that allow individual investors to access assets like private equity and private credit without the high barriers and operational complexity of traditional institutional funds.

While they aren't fully liquid – often capped at 5% redemptions per quarter – they remove the operational friction that stopped many advisors from using private markets in the past.

The Bottom Line

The conversation is moving away from "stocks vs. bonds" to incorporate alternative investments and strategies. By categorizing investments as tools to Hedge, Diversify, Modify, or Amplify, you can help clients understand the strategic purpose of private markets in their portfolio.

2. Investing like family offices: why billionaires obsess over deal structure

The Alternative Investor podcast with Brad Johnson, Episode: How to Invest Like a Family Office with Richard Wilson (Nov. 23, 2025)

TLDR:

Sophisticated family offices focus on negotiating deal structures (like preference equity) rather than just management fees.

AI is used as a "second brain" to replace junior analyst work in due diligence, allowing teams to run leaner.

Investors are shifting to "risk-on" assets like Bitcoin and private credit due to fears of asset inflation.

Beyond the Management Fee

Most advisors fighting for ultra-high-net-worth (UHNW) business focus on lowering their fees or accessing exclusive managers. Billionaires play an entirely different game: they obsess over Deal Structure.

Instead of just asking "what are the fees?", sophisticated families negotiate custom layers. For example, they might ask for "preference equity," where they get paid back first, or "gross revenue royalties" to secure cash flow regardless of profitability.

While retail investors look at the brochure, family offices look for ways to rewrite the contract. If an advisor can bring a deal to a client where the structure itself offers downside protection – like interest-only payments with a balloon payment and seller financing – they demonstrate value far beyond stock picking.

AI as a "Second Brain" for Due Diligence

Previously, a family office might need multiple staff members to screen incoming deals. Now, one person using AI can do the work of three. AI can digest legal documents and pitch decks, flagging risks or summarizing fee structures instantly.

Using the paid versions of these tools (raising the "IQ" of your second brain from 105 to 135) is a non-negotiable expense for modern capital allocators. This allows the human advisor to spend their expensive time on high-level judgment calls rather than reading page 95 of a PPM.

The "Risk-On" Inflation Hedge

Because of "asset inflation" and government debt, asset allocation discussions are shifting to gold and Bitcoin compared.

However, the implementation has changed over the past 5 years. Wealthy families are moving away from cold storage keys and towards institutional-grade access points like Fidelity or BlackRock ETFs. They are also aggressive in private credit and manufacturing recapitalizations, playing "offense" where banks have pulled back.

The Bottom Line

To win UHNW mandates, stop competing solely on access or fees. Start educating clients on structure. Even if you aren't negotiating the deal yourself, teaching a client to ask "Where do I sit in the capital stack?" or "Can we get a gross revenue royalty?" positions you as a true balance sheet advisor, not just an asset gatherer.

3. Oil & gas deals for high-income tax breaks

Passive Income Adventures podcast with Emma Powell, Episode: Oil Profits Unleashed with Cole Oliver, SVP at King Operating Corp (Nov. 26, 2025)

TLDR:

Wealthy clients can use Intangible Drilling Costs (IDCs) to offset active income, not just passive gains.

Moving from single-well bets to diversified funds reduces the "dry hole" risk significantly.

Due diligence must go beyond the pitch deck (e.g., checking state railroad commissions for actual permits and production data).

The Tax Alpha Opportunity

Finding tax relief for high W-2 or active business income is the "holy grail." Unlike real estate depreciation, which often only offsets passive income (unless you are a Real Estate Professional), Intangible Drilling Costs (IDCs) allow investors to deduct 75% to 80% of their investment against their active ordinary income in the first year.

For a client in the top tax bracket investing $100,000, this could mean an immediate deduction of $80,000, resulting in $30,000-$40,000 in actual tax savings. This immediate return on capital through tax mitigation de-risks the investment on day one.

Structure Matters: GP vs. LP

To capture these tax benefits, the investment structure is critical. The client typically enters as a General Partner (GP) for the first year to claim the active deduction, then converts to a Limited Partner (LP) for liability protection.

Oliver warns against the "Wildcatter" model – buying into a single well. That is akin to putting your entire portfolio into one volatile micro-cap stock. Instead, look for funds that mimic a mutual fund structure: a basket of wells across different geographies and stages of development. This approach smooths out cash flow and reduces the risk of total loss from a single dry well.

The "BS Meter" for Due Diligence

When an operator pitches you on a deal, how do you verify their claims? In Texas, for example, you can visit the Texas Railroad Commission website. If an operator claims they are drilling in the Permian Basin, you can look them up to see:

Do they actually hold the leases they claim?

Do they have approved drilling permits?

What is the actual production data of their nearby wells?

If the operator claims to be drilling next week but has no permits filed, that is a red flag.

Additionally, ask about their "workover" strategy. Are they just hunting for new oil, or do they buy distressed assets and use modern technology (like new fracking sand techniques) to revitalize old wells? The latter often provides more predictable cash flow than pure exploration.

The Bottom Line

Oil and gas is volatile, but the tax code offers a unique buffer for high earners. If you have clients looking to offset active income, look for diversified funds (not single wells) that offer the GP-to-LP conversion structure, and try to verify permits on state commission websites before moving money.

Disclaimer

This newsletter is for informational and educational purposes only and should not be construed as personalized financial, tax, legal, or investment advice. The strategies and opinions discussed may not be suitable for your individual circumstances. Always consult a qualified financial advisor, tax professional, or attorney before making any decisions that could affect your finances. While we strive for accuracy, we make no representations or warranties about the completeness or reliability of the information provided. Past performance is not indicative of future results. All investments involve risk, including the possible loss of principal. The publisher, authors, and affiliated parties expressly disclaim any liability for actions taken or not taken based on the contents of this publication.