Why Middle-Market PE Is the Only Real Alpha Left

Welcome to The Smart Portfolio, where each week, we share the best wealth-building ideas from investing podcasts, hedge fund letters, and interviews with wealth builder.

IRRs are lying to you... How do you compare an oil deal against a private credit deal? There's no common yardstick so the "best" opportunity often wins on headline IRR. We're building something to fix this: a standardized "Return per Unit of Risk" score that lets you compare public investments against private deals. If you want early access, reply "COMPARE" or check out dealdx.co (currently onboarding 10 ‘design partners’)

In this issue:

Advisors’ tough choice: diversify and risk underperforming the market?

Why middle-market PE will outperform mega-cap funds going forward

The "12-24 Rule" for HNW allocation to Private Equity

1. Advisors’ tough choice: diversify and risk underperforming the market?

Brown Advisory CIO Perspectives podcast, Episode: AI, Active Management, and the Evolution of Investment Edge with Jordan Wruble (Nov. 25, 2025)

TLDR:

Active managers are struggling to beat benchmarks because market performance is highly concentrated in a few mega-cap names.

"Portable Alpha" strategies allow advisors to keep passive exposure to the index (Beta) while layering on unrelated active returns (Alpha) to boost performance.

AI is becoming a massive productivity multiplier for research, allowing analysts to cover more ground rather than replacing their judgment.

The Concentration Dilemma

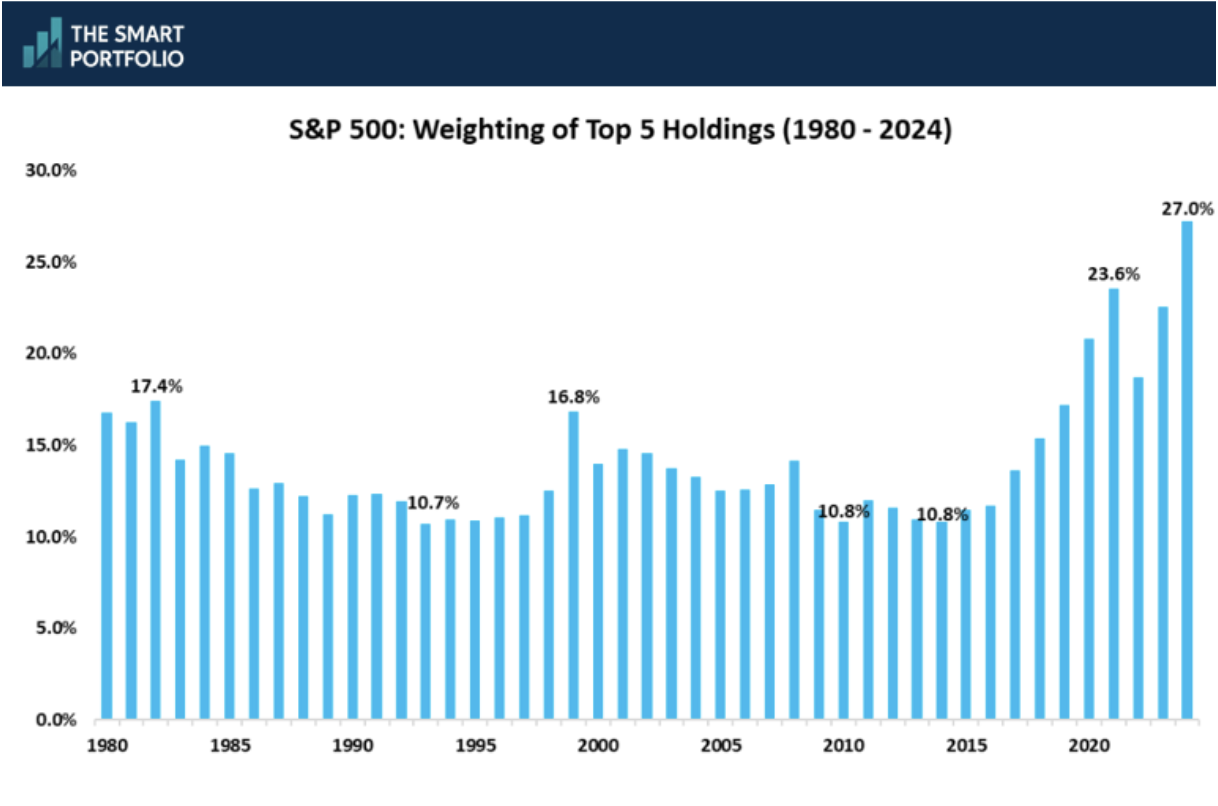

Advisors face a tough choice today: buy the index and end up with massive concentration in the "Mag 7" OR hire active managers who risk underperforming because they are diversified. The "most expensive" quintile of the market is the only one outperforming this year, making valuation-sensitive investing particularly painful.

“If you wouldn't build a client portfolio with 60% of the risk in 10 stocks, why accept a benchmark that does exactly that?” This structural flaw in the market is driving the need for more creative portfolio construction tools.

How Portable Alpha Works

"Portable Alpha" (or "Alpha Extension") is a strategy that separates the market return from the manager's skill. (Understanding Portable Alpha Strategies by PIMCO)

Here is how it works in practice:

Get the Beta: You get exposure to the S&P 500 (the market) through futures or swaps. This ensures you don't miss out if the big tech stocks keep ripping.

Add the Alpha: You use the remaining capital to invest in a "Market Neutral" strategy – a manager who picks long and short positions that net out to zero market exposure. Their goal is pure stock-picking skill.

The result? You get the S&P 500 return plus whatever "extra" return the manager generates, without deviating from the benchmark's exposure. It’s an elegant way to maintain market exposure while potentially outperforming, even in a concentrated market.

Defining "Edge" in Manager Selection

When evaluating managers for these strategies, look for five specific types of "edge":

Informational: Having better data.

Analytical: Connecting the dots better.

Temporal: Having a longer time horizon than the market (patience).

Behavioral: Staying rational when others panic.

Activism: Actually intervening to improve the company.

"Informational" edge is largely gone due to the internet. Today, the biggest edge is often Behavioral (sticking to the plan) and Analytical (using tools like AI to process data faster). AI isn’t a robo-picker; top-performing funds use them as "research assistants" that let a human analyst do 10 hours of work in 10 minutes, raising the bar for everyone.

The Bottom Line

In a market where seven stocks determine the index's direction, traditional stock-picking is dangerous. Consider "Portable Alpha" strategies that lock in the market return (Beta) and stack uncorrelated skill (Alpha) on top of it. This allows you to participate in the rally while still diversifying your sources of return.

2. Why middle-market PE will outperform mega-cap funds going forward

Capital Allocators with Ted Seides podcast, Episode: Democratizing Access to the Middle Market at Future Standard with Michael Kelly (Nov. 23, 2025)

TLDR:

Private equity returns will increasingly come from operational improvements rather than financial engineering.

The biggest risk to advisors isn't the asset class itself, but managing client expectations regarding liquidity.

Middle market firms offer better "alpha" potential than the crowded mega-cap space.

From Aggregator to Creator

For years, the wealth management channel accessed private credit and alternatives largely through "packaging and distribution" firms – companies that took institutional products and wrapped them for retail. Michael Kelly, CIO of Future Standard, compares this early phase to Netflix's DVD era: distributing other people's content.

The industry has shifted. To deliver institutional-grade results to mass affluent clients, firms are now building their own "studios." For advisors, this means access to managers who don't just allocate capital but have the operational teams to fix and grow the companies they lend to or buy.

This is crucial because the old private equity playbook – buying a company, piling on cheap debt, and waiting for multiple expansion – is largely dead due to higher rates. Future returns will come from genuine revenue growth and operational improvements, which are easier to execute in the middle market ($10M–$1B revenue) than in mega-cap companies.

The Liquidity Conversation Script

As an advisor, you are likely seeing a flood of capital moving into semi-liquid structures like interval funds and non-traded BDCs. Kelly warns that the greatest risk in this booming market isn't necessarily a credit bubble, but an "expectations bubble".

Clients must understand the trade-off: they gain access to the illiquidity premium (higher yields/returns), but they lose the ability to cash out instantly. Frame it this way: If a client has a multi-decade horizon (like a 30-year-old with a 401k), it makes zero sense to have 100% of their portfolio in daily liquid assets. However, you must explicitly educate them that they cannot exit "at any moment they want to".

Why Middle Market?

When allocating to private markets, verify where the manager plays. The "Mag 7" equivalent in private equity (the massive players) are now lending to companies that would have been public ten years ago.

The real diversification opportunity lies in the core middle market – private companies with fractured ecosystems where a hands-on partner can actually drive value.

"Financial engineering your way to higher returns... is over".

The Bottom Line

The "60/40" is evolving into models that include significant private market exposure, but your value as an advisor lies in the education process. Ensure clients understand that the "price" of higher yields in private credit is reduced liquidity, and prioritize managers who add operational value rather than just financial leverage.

3. The "12-24 Rule" for HNW allocation to Private Equity

Build Wealth podcast, Episode: How the 12-24™ Rule Builds Ideal Alternative Portfolios with Walker Deibel (Nov. 26, 2025)

TLDR:

The Sweet Spot: Clients should aim for 12 to 24 distinct private positions to balance diversification with upside potential.

The Timeline: This strategy requires a 5 to 10-year horizon, often investing in 2-4 deals per year.

The Logic: Fewer than 12 holdings is too risky; more than 24 dilutes returns into "mutual fund" territory.

The "Redwood" vs. The "Bush" When discussing wealth creation with High Net Worth (HNW) clients, you often encounter a conflict between modern portfolio theory (diversify everything) and how entrepreneurs actually got rich (concentration).

Here’s an analogy from nature that helps bridge this gap. A "bush" diversifies early – it spreads out wide but stays low to the ground. A "redwood" grows extremely tall (accumulates massive wealth) through concentration before it branches out.

The challenge for advisors is helping clients who have already created wealth (the redwoods) transition into investing without becoming a low-growth bush or risking it all on one bad bet.

The 12-24 Framework

For clients interested in private markets (private equity, venture, private credit), the biggest question is "How much is enough?"

The data suggests that a portfolio needs at least 12 positions to provide meaningful diversification against firm-specific failure. However, once a portfolio exceeds 24 positions, it hits a point of diminishing returns. At that point, the winners don't move the needle enough to matter – you’ve essentially recreated a muted index fund structure.

The goal is to stay in that "Goldilocks" zone where the client is protected from total loss but concentrated enough to feel the lift when a portfolio company exits at a 5x or 10x multiple.

How to Implement This with Clients

This framework gives you a concrete roadmap for client capital deployment. Rather than asking a client to dump money into a blind pool all at once, you can structure a multi-year plan.

For a client with investable assets looking to build this bucket, the math is straightforward. If the target check size is $50,000 per deal, and the goal is 24 positions, that is a $1.2 million allocation deployed over time.

A practical pace would be 2 to 4 new positions per year. This allows the client to vintage-diversify (avoiding buying everything at a market peak) and fits a standard 5 to 8-year investment horizon.

The Inefficiency Edge

Finally, it is vital to explain why this works differently than public stocks. Public markets are efficient; information is everywhere. Private markets are inefficient – returns come from operator skill, deal structure, and supply/demand imbalances. By curating 12 to 24 of these "inefficient" opportunities, you are capturing operator edge rather than just market beta.

The Bottom Line

Stop letting HNW clients dabble with one or two angel checks – that is just gambling. Use the 12-24 Rule to frame private investing as a disciplined, multi-year construction project. It provides enough shots on goal to be safe, but few enough to still be lucrative.

Disclaimer

This newsletter is for informational and educational purposes only and should not be construed as personalized financial, tax, legal, or investment advice. The strategies and opinions discussed may not be suitable for your individual circumstances. Always consult a qualified financial advisor, tax professional, or attorney before making any decisions that could affect your finances. While we strive for accuracy, we make no representations or warranties about the completeness or reliability of the information provided. Past performance is not indicative of future results. All investments involve risk, including the possible loss of principal. The publisher, authors, and affiliated parties expressly disclaim any liability for actions taken or not taken based on the contents of this publication.