Who You Ask Determines the Portfolio You Get

Welcome to The Smart Portfolio, where each week, we share the best wealth-building ideas from investing podcasts, hedge fund letters, and interviews with wealth builders.

In this issue:

Research compares financial advice from LLMs, friends and family, and professional financial advisors

Advisors who treat marketing as an investment with measurable returns outgrow those who treat it as an expense to minimize

Instead of competing on returns, compete on client experience

1. Research compares financial advice from LLMs, friends and family, and professional financial advisors

From Humans to Algorithms: How Financial Advice Differs Across Professionals, Peers, and LLMs (Feb 10, 2026) - Link to academic paper

A team from the Deutsche Bundesbank and Goethe University ran an experiment presenting identical investor vignettes to three groups: 424 professional financial advisors, 450 financially literate lay people, and ChatGPT (prompted 300 times). Each advisor recommended a risky portfolio share for retirement savings based on 14 investor characteristics including age, income, wealth, and risk tolerance.

The clever design eliminates two problems that plague financial advice research: conflicts of interest (no commissions involved) and matching bias (everyone sees the same investor profiles, not just their typical clients). This lets researchers isolate pure beliefs about optimal portfolios.

Key insights for wealth managers

Your own portfolio is shaping your advice more than you realize

A 1% increase in an advisor's own risky portfolio share translates to a 2.9 percentage point increase in what they recommend to clients. This effect persists even after controlling for the advisor's age, income, risk tolerance, and return expectations.

This isn't about conflicts of interest. These advisors had no financial incentive to recommend anything. It's pure belief projection. Advisors recommend what feels right to them, and what feels right is anchored to their own portfolios.

Practical implication: Wealth management firms should consider whether advisor-client matching based on risk profiles creates systematic biases. An advisor with 70% equities may unconsciously push clients toward similar allocations. Regular calibration exercises comparing recommendations across advisors for identical client profiles could surface these blind spots.

Professional training creates measurable differences in advice patterns

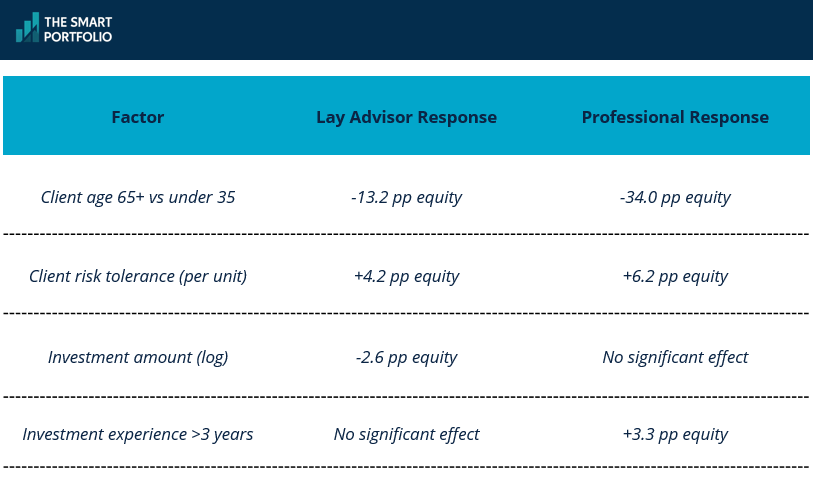

Professionals don't just give different advice. They weight client characteristics differently than laypeople do.

Professionals adjust much more aggressively for age, reducing equity recommendations by 34 percentage points for retirees versus young investors, compared to just 13 points for peer “advisors.” They're also more responsive to declared risk tolerance and investment experience.

Interestingly, professionals don't reduce equity allocations when the investment amount is larger, while lay advisors do. The researchers interpret this through the lens of standard portfolio theory: the ratio of financial wealth to human capital matters more than the absolute dollar amount, and professionals implicitly recognize this.

Practical implication: When benchmarking your advice against industry peers, the relevant comparison isn't average recommendations but sensitivity to client characteristics. Are you adjusting enough for age? Are you letting portfolio size influence recommendations when it shouldn't?

The advice distribution problem: same client, wildly different recommendations

Beyond average recommendations, the variance matters enormously. The researchers used Bayesian methods to estimate the full distribution of advice any given investor might receive from a random advisor of each type.

For a young, low-income investor with medium risk tolerance:

From peers: Median recommendation of 34% equities, but 25% of peers would recommend below 16% and another 25% would recommend above 56%

From professionals: Median of 53% equities, with a similarly wide range

From ChatGPT: Median of 52% equities, but concentrated in a much tighter band (interquartile range of just 17 percentage points versus 35-40 for humans)

This variance isn't noise. It reflects genuine disagreement about optimal portfolios. For wealth managers, this suggests that "second opinion" services (whether human or AI) could provide value by highlighting when a recommendation falls in the tails of the distribution.

Key insights for individual investors

Who you ask shapes the advice you get… a lot!

The research reveals a troubling pattern in how advice flows through social networks. Young, lower-income individuals typically don't access professional financial advisors. Instead, they talk to friends, family, and colleagues; people who tend to share their demographic profile.

But peer advice systematically discourages equity exposure for young investors compared to what professionals would recommend. A young person asking their similarly-aged friends about investing is likely to get more conservative guidance than if they could access a professional.

For a young, low-income investor with low risk tolerance:

Peer recommendation median: 25% equities

Older, wealthy lay advisor median: 37% equities

Professional median: 39% equities

The pattern flips for wealthy retirees. They're more likely to access professional advice, but professionals recommend less equity exposure than the retiree's peers would. A wealthy retiree with medium risk tolerance would hear:

Peer recommendation median: 38% equities

Professional median: 23% equities

The takeaway: The current advice ecosystem may actually suppress stock market participation among those with the longest investment horizons while encouraging more risk-taking among those with the shortest. If you're young and primarily getting financial guidance from friends your age, you may be systematically underinvesting in equities.

ChatGPT as a portfolio reality check

For investors without access to professional advice, ChatGPT offers a surprisingly useful benchmark, with important caveats.

The AI's recommendations fall squarely between peer and professional advice for most investor types, with significantly less variance. It won't recommend you put 0% or 100% in stocks (both of which human advisors occasionally suggest). And it adjusts appropriately for standard factors like age, income, and wealth.

But ChatGPT has one dramatic quirk: it's extraordinarily sensitive to your declared risk tolerance. The marginal effect of risk tolerance on ChatGPT's recommendations is roughly three times larger than for human advisors. Tell it you're risk-tolerant, and it will recommend significantly more equities than most professionals would. Tell it you're risk-averse, and it becomes extremely conservative.

The practical lesson: If you're using AI for portfolio guidance, spend serious time calibrating your risk tolerance inputs. Small differences in how you describe your risk preferences can swing recommendations by 20-30 percentage points. Consider running the same query with slightly different risk tolerance descriptions to understand the sensitivity.

The 50+ advisor effect: why older mentors might give you different advice

The researchers compared advice from peers (same age/income/education) versus older, wealthier individuals, essentially the "successful mentor" archetype.

For young investors, the 50+ crowd consistently recommends higher equity allocations than same-age peers. This makes intuitive sense: older individuals have watched markets recover from multiple downturns and may have more comfort with equity volatility. They're also less likely to recommend zero equity exposure.

However, for the most risk-averse young investors, the 50+ group's advice converges with professional advice. Both are more willing to recommend low equity allocations than same-age peers who might push for "you're young, you should be aggressive."

The takeaway: If you're seeking informal financial guidance, consider expanding beyond your immediate peer group. Someone 20 years older with investing experience may give you a different – and potentially more calibrated – perspective than friends your own age.

The bottom line

This research exposes the hidden influences shaping portfolio advice. Human advisors – whether professional or informal – project their own portfolios onto their recommendations. The advice you receive depends heavily on who you ask, and current access patterns may systematically disadvantage young investors.

For wealth managers, the findings suggest value in structured calibration processes, comparing recommendations across advisors for identical client profiles to surface individual biases. The extreme variance in human advice also creates an opening for AI tools as sanity checks, not replacements.

For individual investors, the core message is simpler: diversify your advice sources. If you're young and primarily talking to peers, you may be getting systematically conservative guidance. If you're older and primarily using professional advice, understand that your advisor's own portfolio is likely influencing their recommendations. And if you're using AI tools, treat risk tolerance inputs as the critical variable they are: small changes in how you describe your preferences will dramatically shift the output.

2. Advisors who treat marketing as an investment with measurable returns outgrow those who treat it as an expense to minimize

Do Business, Do Life podcast: How I'd Approach Marketing as a Financial Advisor (If I Could Start Over) (Feb 10, 2026)

Brad Johnson, who has advised hundreds of top-performing financial services firms, shared the story of a sharp CFP with great plans and zero appointments. The advisor was, as Brad puts it, "the best-kept secret in town." The problem wasn't skill – it was marketing.

Stop making emotional decisions about marketing spend

Here's what Brad sees constantly: An advisor runs a dinner seminar, it underperforms, and they swear off seminars forever. That's primacy and recency bias at work: we remember the first and last experiences most vividly, not the average.

Brad uses a casino analogy that makes ROI tangible. Imagine three slot machines: one returns $2 for every $1, another returns $3. Logically, you'd feed every dollar into the $3 machine. Yet advisors routinely abandon their highest-ROI marketing channels because of one bad experience.

The fix? Track everything mathematically across multiple attempts. When you know the numbers, marketing shifts from an expense you minimize to an investment you maximize.

Why frequency matters as much as ROI

A marketing channel that returns 5x but only runs quarterly will underperform a channel that returns 3x but runs weekly. Brad calls this the "slot machine frequency" problem.

Some high-ROI channels have natural limits. Client appreciation events might convert beautifully but can only happen a few times per year. The advisors who scale understand they need marketing funnels that deliver both strong returns and the ability to "turn up the volume" as needed.

The one-to-many multiplier effect

The biggest leverage play? Stop prospecting one person at a time. Brad points out that working a country club means convincing prospects individually. Running a seminar means one presentation reaches 20-40 people simultaneously.

This gets even more powerful with digital content. YouTube and podcasts are "on-demand one-to-many." A single video answering "When can I roll my 401(k)?" keeps working while you sleep.

The bottom line

Track your marketing ROI ruthlessly, prioritize channels you can scale in frequency, and build at least one system where you're reaching many prospects at once.

3. Instead of competing on returns, compete on client experience

Social 333 podcast: The Strategy Most Wealth Managers Get Wrong w/ CJ Davidson, CEO of Proxy Financial (Feb 10, 2026)

CJ Davidson argues that most financial advisors are playing the wrong game. While they obsess over beating the competition by a few basis points, they're ignoring what clients actually want: an engaging financial experience that helps them live a more fulfilled life.

The "bored client" problem nobody talks about

Davidson has noticed that clients aren't leaving advisors because of poor returns. They're leaving because they're bored. They compare notes at the water cooler, see colleagues doing something more exciting with their money, and suddenly their advisor's steady mutual fund strategy feels stale.

The root cause isn't the strategy – it's the client experience. As Davidson puts it, the health industry figured this out years ago. There's now big business in making exercise fun. But wealth management? It's still operating like it's 1995.

Technology will force the issue

Here's Davidson's wake-up call: "If we are lucky, 10 years from now, no one's touching portfolios or mutual funds or ETFs or stocks anymore. It's all computers." When that happens, advisors who built their value proposition around investment selection will find themselves obsolete.

The advisors who thrive will be the ones who built trust-based relationships focused on helping clients live better lives, and not just accumulate more money. The algorithms will handle the science. Advisors need to become artists who individualize the experience.

The Disneyland test for client engagement

Davidson offers a powerful reframe. There's a difference between a client who can "afford" a family trip to Disneyland and one who takes that trip knowing it fits within a deliberate lifestyle plan. Same destination, completely different emotional experience.

Clients who feel financially prepared – rather than just financially able – enjoy life's milestones more deeply. They're not worried about whether they can afford it. They're present in the moment, watching their kids' faces light up. That feeling of security and intentionality? That's what advisors should be selling.

How to reposition "no" as "here's how"

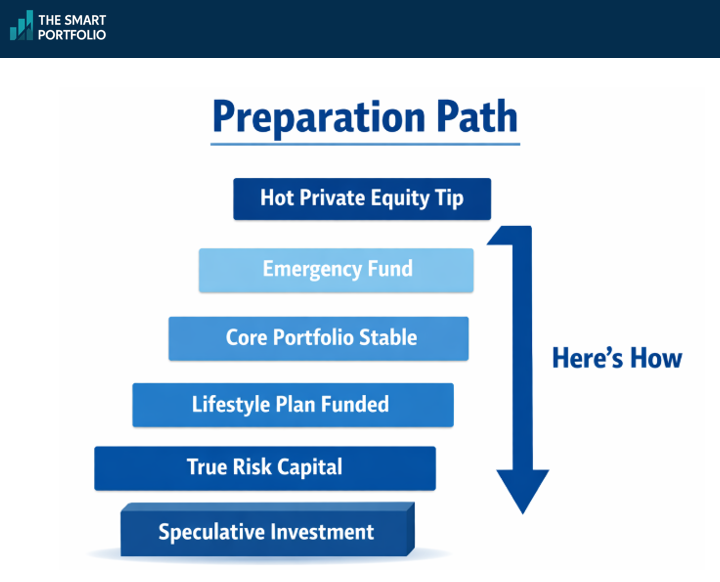

When clients come wanting to chase the latest private equity opportunity or hot stock tip, the fiduciary answer is often "not yet." But Davidson's team doesn't say no, they say "here's how we prepare you."

The pitch: "This is not for the privileged, but for the prepared." They show clients the path to responsible speculation: get the fundamentals locked down first, carve out true risk capital, and then enjoy the ride. If that speculative investment goes to zero, it won't derail the next 40 years.

The bottom line

The advisors who win the next decade won't be the ones with the best returns. They'll be the ones who made wealth management feel as engaging as a Peloton class – fun, personalized, and connected to a bigger vision of how clients want to live.

Disclaimer

This newsletter is for informational and educational purposes only and should not be construed as personalized financial, tax, legal, or investment advice. The strategies and opinions discussed may not be suitable for your individual circumstances. Always consult a qualified financial advisor, tax professional, or attorney before making any decisions that could affect your finances. While we strive for accuracy, we make no representations or warranties about the completeness or reliability of the information provided. Past performance is not indicative of future results. All investments involve risk, including the possible loss of principal. The publisher, authors, and affiliated parties expressly disclaim any liability for actions taken or not taken based on the contents of this publication.