Your Clients Think They’re Diversified, They’re Not

Learn AI from builders in wealth management. We're launching AI Skills workshops to help you understand trends, build custom tools, and automate workflows (taught by the CTOs / Heads of AI building AI tools in your industry, not trainers).

Reply “Skills” to save your spot as a Founding Member (first 100 get 50% lifetime discount).

In this issue:

Navigating 2026’s uncertain environment: ideas from Jeffrey Gundlach, David Rosenberg, Danielle DiMartino Booth, Charles Payne, and Jim Bianco

The passive investing revolution has quietly created portfolios that are far more concentrated than investors realize

How to make sure you’re engaging your clients: from proper word choices to maintaining strong relationships with both spouses

1. Navigating 2026’s uncertain environment: ideas from Jeffrey Gundlach, David Rosenberg, Danielle DiMartino Booth, Charles Payne, and Jim Bianco

DoubleLine Round Table Prime 2026: Best Ideas (Jan 21, 2026)

TLDR:

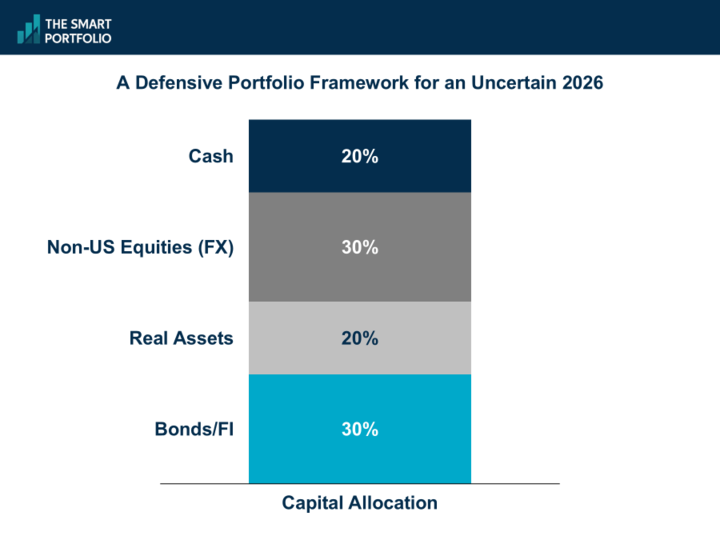

Hold 20% cash to take advantage of buying opportunities expected throughout 2026

Allocate 30% to non-US stocks owned in foreign currencies, and 15-20% to real assets like gold, land, and commodities

Gold remains in a secular bull market driven by central bank buying, with potential to reach $6,000 per ounce

The case for significant cash holdings

David Rosenberg highlighted that Warren Buffett entered 2026 with nearly $400 billion in cash, which is 30% of Berkshire's assets under management. Jamie Dimon announced JP Morgan would deploy excess reserves into Treasuries. Both signals suggest sophisticated investors see better opportunities ahead.

Gundlach recommends 20% cash allocation, noting that 2026 will likely offer more attractive entry points than current valuations. This isn't about timing the market; it's about having dry powder when volatility creates opportunities.

A framework for global diversification

Gundlach's portfolio construction framework suggests 30% in non-US stocks held in foreign currencies, betting that the dollar will weaken. European stocks dramatically outperformed the S&P for dollar-based investors last year. Emerging markets also performed well.

Add 15-20% in real assets: broad commodity indices, gold, real estate, or land. Gundlach personally bought gold miners and land recently. The remainder goes into bonds, favoring seven-year Treasuries and shorter, emerging market debt in local currencies, and UK gilts.

Why gold's rally isn't over

Rosenberg provided the most compelling gold framework. Gold has been in a secular bull market since 1999, though most people just noticed recently. The key driver? Central banks.

In 1980, gold represented 70% of global foreign exchange reserves. Central banks sold systematically for two decades, pushing that figure to just 10% by 1999, and gold to $255 per ounce. Today, gold represents about 25% of reserves. If mean reversion takes it to 35-40%, with gold supply growing only 1% annually while demand grows 2.5%, prices could exceed $6,000.

The beauty of this thesis is that it doesn't depend on inflation fears or geopolitical crises. It's simply about central bank rebalancing back toward historical norms.

Sector preferences for the year ahead

Danielle DiMartino Booth favors utilities and is cautious on financials due to bank exposure to private credit. Charles Payne likes copper, defense stocks, and First Solar. Rosenberg prefers gold miners, Canadian pipelines, aerospace/defense, and energy infrastructure including refineries.

The common thread: real assets, essential services, and companies benefiting from structural tailwinds rather than momentum.

The bottom line

The panel's consensus points toward a defensive, diversified posture: meaningful cash reserves, international diversification, and significant real asset exposure. This isn't about predicting crashes though. it's about positioning portfolios to be resilient across multiple scenarios while maintaining the flexibility to act when opportunities emerge.

2. The passive investing revolution has quietly created portfolios that are far more concentrated than investors realize

Livewire Markets podcast: You bought diversification. You're getting concentration w/ Chris Hestelow from Allan Gray Australia (Jan 21, 2026)

TLDR:

Investors in MSCI World have more money in 7 US tech stocks than in the next 7 largest countries combined

The combination of concentration AND expensive valuations creates the real risk

True diversification means assets that behave differently, not just more assets

The numbers behind the illusion

When clients invest in an MSCI World index fund, they believe they're getting broad global exposure across over 1,000 companies. The reality is different: 72% is now invested in US equities, and the Magnificent Seven tech stocks alone outweigh the next seven largest countries in that index.

Three hidden risks in passive investing

The first is concentration, but that's only part of the problem.

The second is valuation insensitivity: passive funds buy based on company size, not whether the price makes sense. As a stock rises, index funds automatically buy more of it regardless of fundamentals.

The third risk is momentum bias. With new money flowing into passive vehicles, yesterday's winners keep getting more investment dollars. This works beautifully when trends continue. It becomes dangerous when they reverse.

What can you do about this

Hestelow isn't suggesting abandoning passive investing. Instead, he recommends complementary exposures that provide genuine diversification.

One surprising fact: emerging markets aren't included in MSCI World (they're in MSCI All Country World). Adding emerging market exposure creates significant diversification because it's an entirely separate pool of companies.

The bottom line

The advice isn't to avoid passive investing – it's to help clients understand that diversification isn't about owning more assets. It's about owning assets that behave differently. When 7 US tech stocks represent more portfolio weight than entire countries, the "diversified" label deserves an asterisk.

3. How to make sure you’re engaging your clients: from proper word choices to maintaining strong relationships with both spouses

The complete advisor podcast: Why Good Advisors Lose Clients: The Communication Problems No One Talks About (Jan 12, 2026)

TLDR:

Research shows specific words trigger negative reactions from clients – “strategy” is much better than “solution”

The average widow is 59.4 years old, and if you don't know both spouses equally well, those assets will leave when one passes

Start income planning conversations five years before retirement to retain existing assets and capture outside holdings

The word problem you didn't know you had

Jeannie Underwood from Global Atlantic spent years conducting focus groups with consumers about the language financial professionals use. What they found was surprising: words that sound professional to advisors often alienate clients.

For example, "solutions" tested poorly because clients felt it was presumptuous – as if the advisor assumed they had a problem. The word "strategy," however, resonated strongly. Clients described it as feeling "customized" and "exciting."

Small language shifts like using "plus" instead of "and" or "zero" instead of "no" consistently improved emotional responses.

The spouse you're ignoring holds your at-risk assets

The average age of a widow is 59.4 years old. If your baby boomer clients follow traditional patterns where one spouse handles long-term finances and the other manages day-to-day expenses, you likely have a relationship with only one of them.

Underwood recommends a simple audit: create a T-chart for your top 10 households. List five basic questions like: where each spouse grew up, their career, and their money goals. Answer what you know about each person. If there are gaps on one side, you have work to do.

Practical tactics include making two folders for every meeting – one for each spouse – with a handwritten note to the one who didn't attend. Consider addressing correspondence to the less-engaged spouse first. These small gestures open doors without disrupting established family dynamics.

The fragile decade is your retention opportunity

The five years before retirement and five years after represent what researchers call the "fragile decade." People in this window described feeling financially and emotionally vulnerable for the first time in their lives.

Here's why this matters: clients approaching retirement typically work with two to three financial professionals. The advisor who initiates the income plan conversation first is most likely to consolidate those outside assets.

Segment your book by clients who are five to seven years from retirement. Reach out proactively: "My job is to ensure that when your paycheck stops, your income doesn't skip a beat."

The bottom line

Your technical expertise matters less than how you communicate it. Audit your client relationships for engagement gaps, especially with spouses. Start income planning conversations early to position yourself as the consolidation point for all household assets.

Disclaimer

This newsletter is for informational and educational purposes only and should not be construed as personalized financial, tax, legal, or investment advice. The strategies and opinions discussed may not be suitable for your individual circumstances. Always consult a qualified financial advisor, tax professional, or attorney before making any decisions that could affect your finances. While we strive for accuracy, we make no representations or warranties about the completeness or reliability of the information provided. Past performance is not indicative of future results. All investments involve risk, including the possible loss of principal. The publisher, authors, and affiliated parties expressly disclaim any liability for actions taken or not taken based on the contents of this publication.