You Can’t Ignore Alternatives. But You Can Get Them Wrong.

Learn AI from builders in wealth management. We're launching AI Skills workshops to help you understand trends, build custom tools, and automate workflows (taught by the CTOs / Heads of AI building AI tools in your industry, not trainers).

Reply “Skills” to save your spot as a Founding Member (first 100 get 50% lifetime discount).

In this issue:

You can't afford to ignore alternatives… here's how to navigate the risks

Why family offices obsess over downside protection, and what you can learn from it

BlackRock’s $14 trillion AI investment strategy

1. You can't afford to ignore alternatives… here's how to navigate the risks

Advisor Wars podcast, Episode #1: Alternative Investments with Obsidian CIO (1/14/26)

TLDR:

Major asset managers like Apollo and BlackRock are marketing alternatives directly to retail investors – advisors must have a compelling answer when clients ask about them

Understanding the underlying exposures in any alternative investment is non-negotiable; if you can't explain what you're investing in, move on

Interval funds offer operational simplicity but hide real liquidity risks – only 5% of investors can exit quarterly, creating potential multi-year lockups during stress

Joe Halpern has spent 30 years in complex financial products, including expert witness work on one of the largest financial frauds in US history. Now, as Managing Partner of Obsidian CIO, he's sounding the alarm: advisors who ignore alternatives are taking a business risk they can't afford.

The competitive pressure is real

Apollo recently sponsored a section of the Wall Street Journal dedicated to alternatives. BlackRock and JP Morgan have massive marketing budgets pushing these products to mass affluent consumers. Your clients are seeing these messages.

Here’s a scenario: your largest client calls and says a competitor just pitched them a "30% annually" alternative investment. What's your answer? Even if your answer is "alternatives are too risky for your situation," you need an answer.

One RIA Halpern partnered with scaled from $100 million to over $1.25 billion by strategically incorporating alternatives. It wasn't just about investment returns – it was about having a compelling story in a marketplace that increasingly demands one.

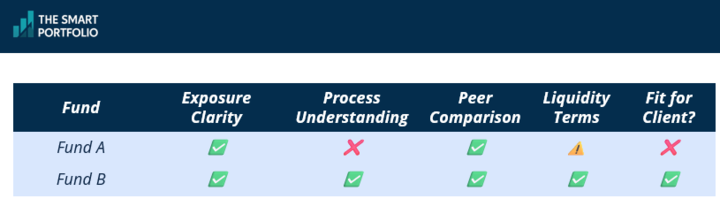

The three-part due diligence framework

Halpern's approach to evaluating alternatives comes from hard-won experience:

First, understand the underlying exposure. What exactly are you investing in? If it's a complex CLO structure or waterfall arrangement you can't explain, pass. Halpern, who built a career in derivatives, admits some products are too complicated even for him, and that's okay. Move on.

Second, understand the process. How does the manager behave in different market regimes? What does the portfolio look like over time, not just at a single point? History rhymes but never repeats exactly. You want managers who've thought through their worst-case scenarios.

Third, create competition. Talk to every manager in a space and let them know who they're competing against. Managers know each other's weaknesses. There's no such thing as an all-weather portfolio, and this process helps expose where each strategy is vulnerable.

The interval fund trap

Interval funds look attractive: simple tax reporting, no capital calls, operational ease, and quarterly liquidity. But that 5% quarterly redemption limit becomes painful fast.

Consider the math: if 50-75% of fund holders want out simultaneously, which is common when a strategy struggles. In a case like that, you might have to wait 18 months to fully exit. That $100,000 you committed in a single day could take years to recover in a stressed scenario.

Platforms like iCapital and CAIS provide access and basic fraud screening, but the strategy selection and sizing decisions remain your responsibility.

The bottom line

Alternatives are risky and operationally complex but the business risk of not participating may be greater. Develop a clear philosophy, conduct rigorous due diligence on exposures and processes, and size positions appropriately. The secular trend is too powerful to ignore, but it demands careful navigation.

2. Why family offices obsess over downside protection, and what you can learn from it

How I Invest podcast: Why Billionaires Invest Differently w/ Robert Blabey (1/16/26)

TLDR:

Family offices approach every investment by asking "how quickly can we lose our capital?" before considering upside – a mindset shift advisors can adopt

Shorter duration investments (1-5 years) reduce macro risk exposure while maintaining attractive returns through faster capital rotation

Family offices collaborate rather than compete, creating curated deal flow that's more selective than institutional pipelines

Family offices manage institutional-level capital but think about risk completely differently than most professional investors. Robert Blabey, who spent years as CIO for several family offices before founding Align Private Capital, shared how ultra-wealthy families actually invest.

The credit lens applies to everything

At Align, every investment – whether it’s equity, real estate, commodities, or credit – starts with one question: "How quickly can we get hurt?" The team stress tests each opportunity by imagining the worst-case scenario. What could go wrong? How fast? What's the exit if things deteriorate?

This isn't pessimism. It's prioritization. As Blabey explains, "If you don't lose it first, you have a lot better chance of making it in the future." Even when investing in equity-like opportunities, they want credit-like protections. The ideal scenario is credit protections with equity upside.

Why shorter duration beats buy-and-hold for risk management

Most institutional investors avoid short-duration deals because they don't want the hassle of redeploying capital every 12-18 months. Blabey sees this as a feature, not a bug.

His reasoning is simple: the only guaranteed way to not lose money is to not invest. Therefore, minimizing how long your money is exposed reduces risk. Their office joke captures it perfectly: "there's a hundred-year storm in the macro world every two years."

By rotating through 1-5 year investments, they stay positioned to capitalize on dislocations. When Russia invaded Ukraine and credit markets seized up, they had capital ready to deploy at attractive discounts. Longer-term investors were locked in place.

The collaborative family office network

Unlike institutional investors competing for AUM, family offices freely share deal flow. A healthcare-focused family might know the science and market dynamics but want partners who understand capital structure. Specialists complement each other instead of competing.

This creates a curated funnel. Where typical investors see 3,000 deals to do 10, family offices work from a narrower, higher-quality pipeline delivered by trusted partners who are inviting them in – not pitching them.

The bottom line

The wealth preservation mindset isn't just for billionaires. Advisors can apply this framework by asking the downside question first on every investment, considering shorter-duration alternatives to reduce macro exposure, and building collaborative relationships that improve deal quality. Protecting capital isn't conservative; it's how generational wealth survives.

3. BlackRock’s $14 trillion AI investment strategy

Full Signal podcast: BlackRock’s $14 trillion AI investment strategy REVEALED w/ Gargi Chaudhuri (1/15/26)

TLDR:

AI stocks' forward P/E fell from 29 to 26.5 during 2025 because earnings grew faster than prices… valuations contracted despite strong returns

Most advisor portfolios are still underweight large cap growth and AI themes, maintaining a small cap and value tilt that hasn't been rewarded

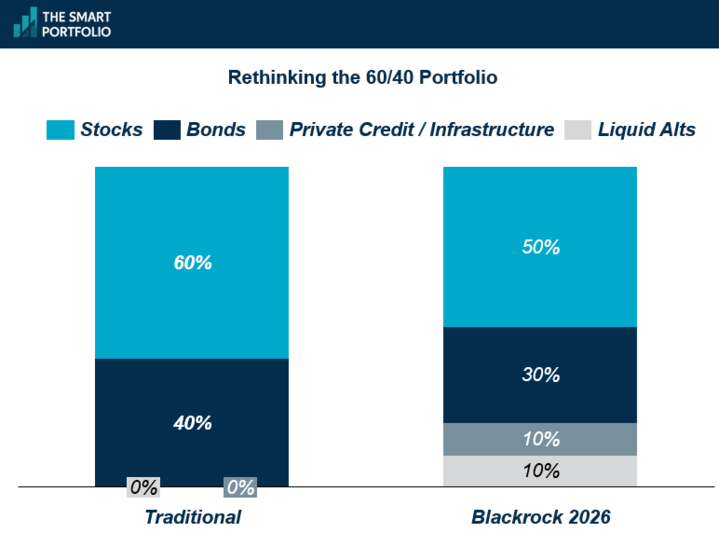

The 60/40 portfolio needs upgrading to 50/30/10/10 with private credit, infrastructure, and liquid alternatives providing diversification beyond bonds

Gargi Chaudhuri, BlackRock's chief investment strategist for the Americas, handles one of the most common client objections: haven't we missed the AI trade?

The math on AI valuations

At the start of 2025, AI stocks traded at 29x forward earnings – expensive by any measure. By year end, that multiple dropped to 26.5x. The returns were still strong (approximately 20%), but every dollar of return came from earnings growth, not multiple expansion.

The top 50 S&P 500 companies with AI exposure grew net income by 30% over three years. Non-AI companies grew about 3%. That earnings differential, combined with substantial free cash flow generation, justifies continued allocation. But advisors need to understand they're paying for demonstrated growth, not speculation.

Where portfolios remain underweight

BlackRock analyzes advisor portfolio allocations, and the data shows something counterintuitive: most portfolios still have a small cap and value tilt, leaving them underweight the large cap growth theme that's driven market returns.

If clients don't have AI exposure, the recommendation is to add some large cap growth allocation. The theme isn't played out, but it is broadening beyond the Mag 7 into power infrastructure, healthcare applications, and emerging markets with AI exposure like Taiwan and Korea.

The diversification playbook for 2026

BlackRock frames diversification as two separate strategies: diversifying within AI and diversifying away from AI.

Within AI means moving beyond hyperscalers into power buildout, connectivity infrastructure, and emerging market beneficiaries. The firm expects $5-8 trillion in infrastructure buildout through 2030. That spending benefits sectors beyond chip makers.

Away from AI means emerging markets broadly, value stocks (which BlackRock expects will show stronger earnings growth in 2026), and income-generating assets as rates decline. Gold and Bitcoin both receive mention as diversifiers, though sizing appropriately matters given Bitcoin's volatility.

Rethinking the 60/40

The traditional 60/40 portfolio isn't dead, but it needs evolution. Stock-bond correlations have returned to negative territory (bonds providing protection when stocks fall), but that relationship isn't as reliable as pre-pandemic.

BlackRock's recommended structure is closer to 50/30/10/10 into stocks, bonds, private credit or infrastructure (for those who can access it), and liquid alternatives or diversifiers like gold. The goal is diversifying your diversifiers, not relying solely on bonds to provide portfolio balance.

With $9 trillion sitting in cash earning declining rates, clients need income from multiple sources. Dividend-focused equity strategies and the 3-7 year part of the bond curve both offer opportunities as front-end rates compress.

The bottom line

Valuation concerns about AI may be overstated – earnings growth justified 2025 returns. But the smarter play is broadening exposure across the AI value chain and adding uncorrelated diversifiers beyond bonds. The theme still has room to run, but concentrated positions in seven stocks leave portfolios exposed to risks that proper diversification can mitigate.

Disclaimer

This newsletter is for informational and educational purposes only and should not be construed as personalized financial, tax, legal, or investment advice. The strategies and opinions discussed may not be suitable for your individual circumstances. Always consult a qualified financial advisor, tax professional, or attorney before making any decisions that could affect your finances. While we strive for accuracy, we make no representations or warranties about the completeness or reliability of the information provided. Past performance is not indicative of future results. All investments involve risk, including the possible loss of principal. The publisher, authors, and affiliated parties expressly disclaim any liability for actions taken or not taken based on the contents of this publication.