Before You Add Alternatives, Read This

Learn AI from builders in wealth management. We're launching AI Skills workshops to help you understand trends, build custom tools, and automate workflows (taught by the CTOs / Heads of AI building AI tools in your industry, not trainers).

To save your spot as a Founding Member (50% lifetime discount), reply “Skills” by Jan 31.

In this issue:

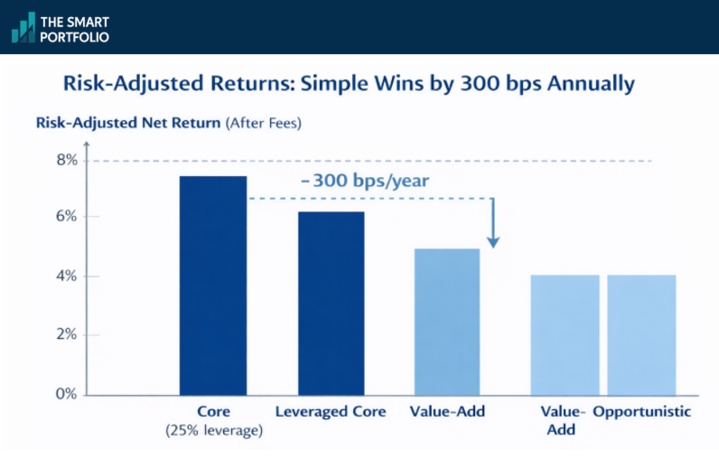

Chicago Booth: High-fee real estate funds that pitch high expected returns actually underperform boring core strategies by 300 bps annually

How the growing influence of passive investing creates unique investment opportunities without taking on more risk

JP Morgan's 2026 alternatives outlook

1. Chicago Booth: High-fee real estate funds that pitch high expected returns actually underperform boring core strategies by 300 bps annually

Chicago Booth Review podcast: Will alternative investments underperform? (1/6/26)

TLDR

Value-add and opportunistic real estate funds have underperformed simple leveraged core strategies by approximately 300 basis points annually on a risk-adjusted basis

High fees (300-400 basis points for non-core vs. 100 for core) and excessive leverage (65-85% vs. 25%) eat into returns while enriching fund managers through promote structures

For clients wanting real estate exposure, publicly traded REITs may offer better risk-adjusted returns with full liquidity and transparent pricing

Joe Pagliari, a real estate expert at Chicago Booth, has research findings indicating that the riskier real estate private equity strategies that pension funds and endowments have poured money into are NOT delivering returns that justify their complexity and fees.

The David Swensen legacy that went sideways

The modern alternatives movement traces back to David Swensen at Yale's endowment in the mid-1980s. His thesis was: endowments with infinite time horizons should capture illiquidity premiums by investing in private markets. The strategy worked brilliantly for Yale.

The problem? Everyone copied it. As Pagliari puts it, "too much capital chasing too few deals." Steve Kaplan's research at Booth shows the spread between private and public market returns has compressed over time. And Richard Ennis, former editor of the Financial Analyst Journal, found that as endowments increased alternative allocations, their performance relative to a simple 60/40 benchmark actually declined.

Core vs. value-add vs. opportunistic: the math doesn't add up

Core real estate funds invest in stable, well-leased properties. Think a grocery-anchored shopping center with a national tenant. They carry about 25% leverage and charge roughly 100 basis points in annual fees.

Value-add funds buy properties needing renovation or repositioning. They use 65-85% leverage and charge around 300 basis points annually.

Opportunistic funds do ground-up development with similar leverage and fees approaching 400 basis points.

The theory says higher risk should mean higher returns. The reality? When Pagliari adjusts for both fees and risk, value-add and opportunistic funds underperform leveraged core strategies by about 300 basis points per year. That's a staggering amount of value destruction.

The promote structure creates misaligned incentives

The culprit is partly structural. Non-core funds pay general partners a "promote" or carried interest – typically 20% of profits above an 8% preferred return. This promote functions like an option: its value increases with volatility.

More leverage means more volatility, which means more valuable promotes for fund managers. So managers are incentivized to pile on debt, which increases expected returns on paper but also increases risk in ways that benefit the GP at LP expense. The limited partners – pension funds, endowments, and ultimately retirees – bear the downside.

What to consider instead

Pagliari offers two practical alternatives. First, if investors / clients want private real estate exposure, consider leveraging core strategies rather than chasing non-core funds. You get similar return profiles with lower fees and more stable underlying assets.

Second, publicly traded REITs offer real estate exposure with transparent pricing, low fees, full liquidity, and no idiosyncratic property risk.

Yes, you'll see daily volatility – but that volatility was always there in private funds, just hidden through "slow-moving marks" that Cliff Asness famously called "volatility laundering."

The bottom line

The next time a wholesaler pitches an opportunistic real estate fund promising superior returns, remember this: on average, you’d likely do better with a boring, leveraged core fund, or even a basket of REITs. The fee drag and risk-adjusted underperformance of non-core strategies is a 300 basis point headwind that's hard to overcome, no matter how compelling the pitch deck looks.

2. How the growing influence of passive investing creates unique investment opportunities without taking on more risk

We Study Billionaires podcast: The Search for Mispriced Stocks w/ Clay Finck (1/8/26)

TLDR

As passive investing dominates (now over 50% of US capital), fewer investors are doing fundamental analysis, creating wider gaps between price and value in overlooked market segments.

Companies outside major indices often trade at significant discounts despite exceptional business quality and management.

Building client portfolios with lower risk and higher returns is possible by focusing on quality companies with strong capital allocation and avoiding overleveraged businesses.

The investment landscape has fundamentally shifted. With over half of US market capital now invested passively through index funds and ETFs, an increasingly small subset of investors actually analyzes individual businesses. For wealth managers seeking alpha for their clients, this creates a paradox: the rise of passive investing may have made active stock selection more rewarding than ever.

The passive investing paradox

Daniel Gladis, founder of the Vltava Fund, argues in his book Hidden Investment Treasures that passive investors have shifted from price takers to price makers. His fund has delivered 511% returns versus 333% for global benchmarks over 16 years.

The thesis is simple: when most market participants buy stocks without considering valuation, mispricings widen.

Jack Bogle himself warned that if everyone indexed, markets would fail. We're not there yet, but with an estimated 80% of capital either passive or closet-indexing, the price discovery mechanism has weakened considerably.

Examples of mispricings due to passive investing

Consider Markel Group, often called "Baby Berkshire." This specialty insurer has compounded at over 100x since 1990, yet trades at modest multiples because it sits outside major indices. CEO Tom Gayner has beaten the S&P 500 by 1% annually over 20 years while managing a highly diversified portfolio. The company generates $1.5 billion in annual profits with a market cap around $20 billion.

Even more striking is NVR, the homebuilder that emerged from bankruptcy in 1992 with a revolutionary business model. By using land options instead of outright purchases and focusing on pre-sold homes, NVR achieves nearly 80% returns on invested capital. Over 30 years, they've reduced shares outstanding by over 80% through buybacks. Yet it trades at just 16x earnings – a 30% discount to the market – because investors lump it with cyclical homebuilders.

Building lower-risk, higher-return portfolios

The conventional wisdom that higher returns require higher risk breaks down when you examine how permanent capital loss actually occurs.

The main culprits are poor business quality, excessive debt, and bad management decisions. By inverting this – focusing on high-quality businesses with minimal debt and proven capital allocators – investors and advisors can construct portfolios that are both safer and more rewarding than broad market indices.

The bottom line

The dominance of passive investing has created what may be the most favorable environment for fundamental analysis in decades. If you’re willing to venture beyond the S&P 500's top holdings, overlooked segments like specialty insurance, efficient homebuilders, and international markets offer compelling opportunities to differentiate portfolios while potentially reducing risk.

3. JP Morgan's 2026 alternatives outlook

Alternative Realities podcast by JP Morgan Asset Management: What trends will shape alternatives in 2026? (1/8/26)

TLDR

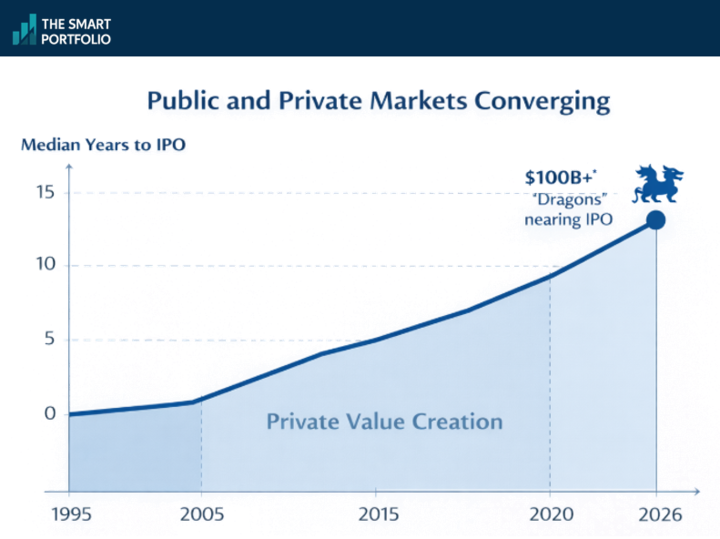

Public and private markets are converging rapidly, with companies now taking 14 years to IPO versus just 5 years in the late 1990s

Secondary markets have become a $250+ billion opportunity that provides new liquidity options for clients stuck in private investments

Hedge funds are making a comeback thanks to higher cash rates, elevated volatility, and low stock correlations – a shift from the "alpha winter" of the past decade

JP Morgan Asset Management just released their 2026 Alternative Investment Outlook, drawing on insights from 45 contributors across their $500 billion alternatives platform.

The private-public line is blurring fast

The traditional boundary between public and private markets is disappearing. Jed Laskowitz, JP Morgan's Global Head of Private Markets, points out that the median time to IPO has stretched to 14 years – nearly triple what it was in the late 1990s. This means clients who want exposure to sizeable high-growth companies increasingly need access to private markets.

What's notable: mega private companies valued near $1 trillion are now considering going public. This creates a new dynamic where your clients could see these "dragons" (as the team calls them) enter the public market for the first time as already-massive businesses.

Secondary markets offer new liquidity solutions

One of the biggest client concerns about alternatives is illiquidity. The secondary market now exceeds $250 billion and is growing rapidly. There are two flavors:

LP-led secondaries (when an investor needs to sell their fund stake)

GP-led secondaries (when fund managers bundle assets for sale)

For clients worried about being locked into private investments, this growing secondary market provides an escape valve that didn't exist at scale before. Some private company shares now trade almost daily.

Why hedge funds deserve a second look

After what Anton Pil calls the "alpha winter" of the last decade, hedge funds are experiencing renewed momentum driven by three factors:

cash rates are no longer zero,

equity volatility is elevated, and

individual stock correlations are low.

This combination creates more opportunity for skilled managers to generate alpha.

For portfolio construction, hedge funds offer something valuable: they can "zig when other things zag." When both stocks and bonds sold off simultaneously two years ago, hedge funds held up relatively well.

The bottom line

As investors / clients ask about alternatives in 2026, focus on three themes: the power play in infrastructure (energy demand is growing 2-5% annually after decades of being flat), the liquidity improvements in private markets through secondaries, and hedge funds as a true diversifier when traditional 60/40 correlations break down. Most importantly, manager selection matters enormously. The spread between top and bottom quartile managers is wide and widens further during stress.

Disclaimer

This newsletter is for informational and educational purposes only and should not be construed as personalized financial, tax, legal, or investment advice. The strategies and opinions discussed may not be suitable for your individual circumstances. Always consult a qualified financial advisor, tax professional, or attorney before making any decisions that could affect your finances. While we strive for accuracy, we make no representations or warranties about the completeness or reliability of the information provided. Past performance is not indicative of future results. All investments involve risk, including the possible loss of principal. The publisher, authors, and affiliated parties expressly disclaim any liability for actions taken or not taken based on the contents of this publication.