IRRs Are Lying to You: Here’s How to Compare Risk the Right Way

Each week, we share the best wealth-building ideas from investing podcasts, hedge fund letters, and interviews with wealth builders

How do you compare an oil deal against a private credit deal? We're building a standardized "Return per Unit of Risk" score that lets you compare public investments against private deals. Reply "COMPARE" or check out dealdx.co for early access.

In this issue:

What advisors (and their clients) must understand before adding alternatives

Why private markets are becoming essential for client portfolios

Finding the 1% of stocks that actually compound wealth

1. What advisors (and their clients) must understand before adding alternatives

The Rational Reminder podcast, Episode #386: Is Anyone Doing Due Diligence? with Aravind Sithamparapillai (12/4/25)

TLDR:

Advisors recommending alternatives should be able to explain basic mechanics like duration risk or how NAV stability is maintained

"Extend and pretend" allows troubled funds to mask problems, until gating suddenly locks client assets

If you can't explain why an alternative's returns are higher than comparable public investments, you need to do some more due diligence

Aravind Sithamparapillai became known in Canadian advisor circles for asking uncomfortable questions at conferences – questions that exposed gaps in fund managers' explanations. His experience reveals how little due diligence actually happens before advisors recommend alternatives.

The extend and pretend problem

At a 2023 conference, a mortgage investment fund claimed ultra-short loan duration and stable returns despite rising interest rates. When Sithamparapillai pressed, the presenter admitted they were extending loans at the same rates rather than repricing, because increasing rates would trigger defaults on underwater properties.

By not forcing defaults, they avoided marking down NAV. The fund looked stable while masking deteriorating fundamentals. This "extend and pretend" strategy works until it doesn't. A year later, a similar fund that Sithamparapillai questioned gated – suddenly locking investors out of their capital.

The due diligence questions you should be able to answer

Before recommending any alternative, you should be able to explain:

Why are returns higher than comparable public investments?

What happens to NAV if underlying assets decline?

How does the fund handle redemptions during stress?

What operational risks exist in the legal structure?

Sithamparapillai found that fund salespeople often couldn't answer these questions themselves. When he asked why a private debt fund's yields weren't rising with interest rates, the salesperson "laughed awkwardly" and said he'd get back – then never did.

The marketing tactics to recognize

Common alternative fund marketing techniques include:

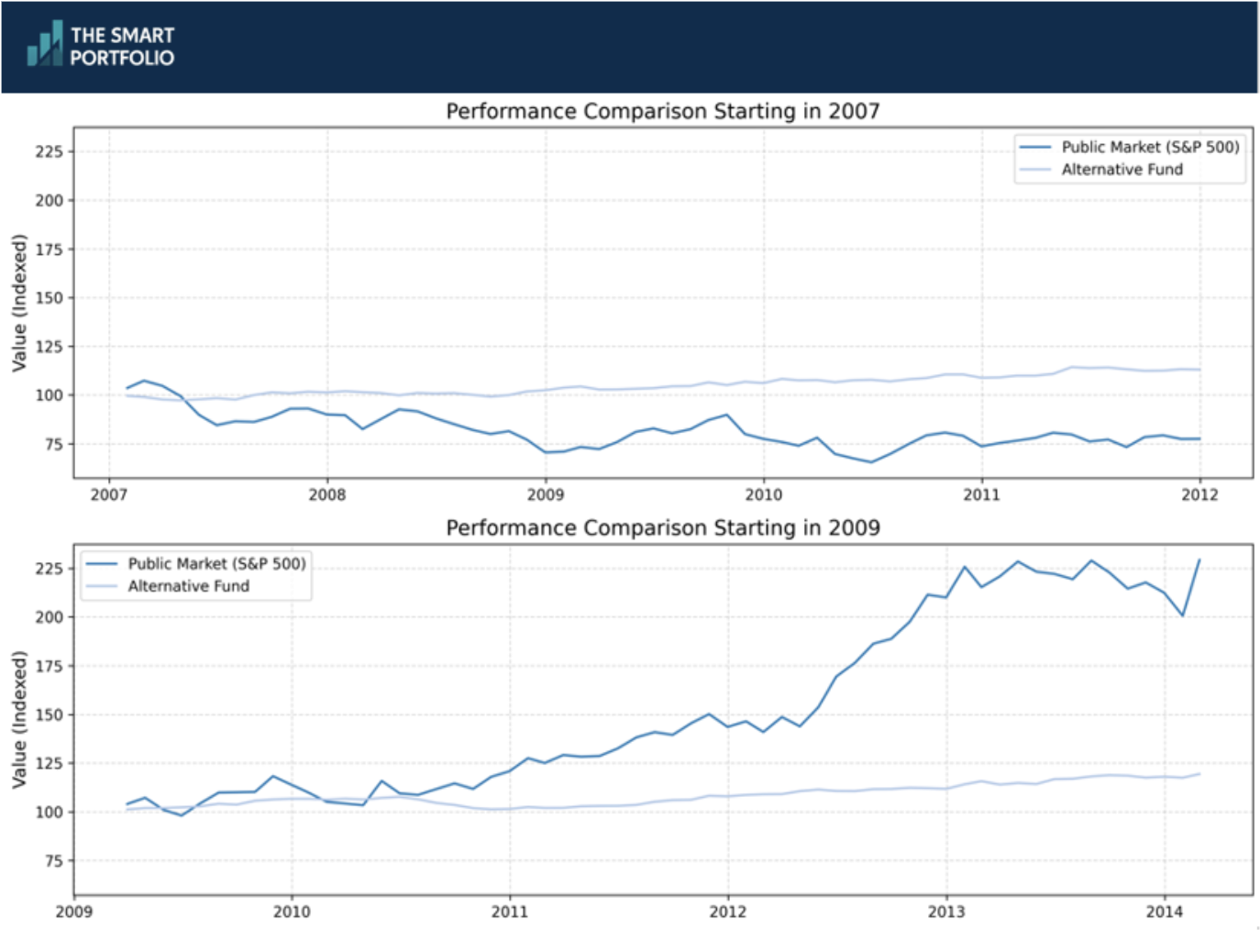

Starting performance charts right before a public market crash (2007 or 2008)

Stacking IRRs across vintages to inflate since-inception returns, and

Showing stable NAVs that reflect appraisal policies rather than actual values.

Starting performance charts right before a public market crash (2007 or 2008)

This is cherry-picking the comparison baseline. If you start a performance chart in late 2007 or early 2008, your public equity benchmark (S&P 500) immediately shows a ~50% drawdown during the financial crisis. Meanwhile, your alternative fund—with its quarterly appraisal-based NAV—shows a much gentler decline (maybe 15-20%) because private valuations lag and smooth out volatility.

The resulting chart makes the alternative fund look dramatically better on both absolute returns and risk-adjusted basis. The Sharpe ratio comparison is especially flattering because the alt fund appears to have delivered equity-like returns with bond-like volatility.

If you instead started the same chart in March 2009, the public markets would show the massive recovery rally, and the comparison would look very different—likely favoring public equities significantly.

Stacking IRRs across vintages to inflate since-inception returns

This one's more technical. Say a GP has raised funds in 2012, 2015, 2018, and 2021. Each vintage has its own IRR. When they report a "since-inception IRR" for the firm, they're combining these vintages, but the math of how IRRs aggregate can be misleading.

A few ways this inflates numbers:

Survivor bias in the composite: Early, smaller funds often had better returns (less capital chasing deals, lower purchase multiples). By blending a great 2012 fund with a mediocre 2021 fund, the "since inception" number still looks strong even though recent performance has deteriorated.

Capital-weighting games: IRR is sensitive to timing and magnitude of cash flows. How you weight and combine the vintages affects the composite number—and there's no standardized methodology.

Denominator manipulation: Unrealized investments in recent vintages are still marked near cost, so they don't drag down the composite yet. An LP who invested only in the 2021 vintage would have a very different experience than the blended number suggests.

None of the above means that all alternatives are bad. It just means that the burden of understanding sits with you (or your advisor).

The bottom line

The alternative investment space has become a dominant industry talking point, yet due diligence often amounts to "everyone else is doing it." For advisors, the risk isn't just underperformance – it's clients locked out of their money during gating events you didn't prepare them for. If you can't explain the mechanics, you shouldn't recommend the product.

2. Why private markets are becoming essential for client portfolios

Masters in Business - Bloomberg podcast: Why Private Assets Are Essential: Masters in Business with Stephanie Drescher (1/2/26)

TLDR:

Institutions allocate 20%+ to private markets vs just 3% for individual investors – a gap that represents massive opportunity

New structures like semi-liquid funds and ETF wrappers are making private market access practical for wealth clients

Regulatory changes around 401(k)s signal a global shift toward democratizing private market access

Stephanie Drescher, Apollo's Chief Client and Product Development Officer overseeing $840 billion in assets, spent 21 years watching private markets evolve from niche to necessity. Her message to investors and financial advisors is clear: the historical divide between institutional and individual portfolio construction is collapsing.

The allocation gap to understand

Institutions average over 20% allocation to private markets. Individual investors? Just 3%. Both pools represent roughly $150 trillion globally. Drescher argues this gap exists not because private markets are inappropriate for individuals, but because access has historically been limited.

But the math really matters... When the S&P 500's performance is concentrated in roughly seven stocks, traditional public market exposure alone may not provide the diversification clients assume they're getting.

How access is changing

Apollo has invested $1 billion specifically in wealth technology to make private market access practical for advisors. The developments reshaping access include interval fund structures that offer point-and-click purchasing, ETF wrappers that include private market exposure, and semi-liquid products that provide quarterly redemption options.

This means that the operational complexity that once made private allocations impractical – the subscription documents, K-1s, and reporting challenges – is being engineered away.

Regulatory tailwinds to watch

Executive orders around 401(k) access to alternatives, Europe's LTIF 2.0 framework, and UK pension requirements are creating global momentum. Drescher observes that regulators are shifting from a "lowest fee" mentality to a "maximize outcome" approach, recognizing that illiquidity premiums can serve long-term retirement goals.

The key insight: 401(k) participants have decades-long time horizons yet are typically limited to daily-liquid investments. This mismatch is exactly what regulatory changes aim to address.

The bottom line

Private markets have moved from "nice to have" to "need to have" for meeting long-term client goals. Investors and Advisors who understand these products – and can explain them clearly – will be positioned to serve clients seeking institutional-quality portfolio construction.

3. Finding the 1% of stocks that actually compound wealth

Invest like the best podcast: Finding The 1% of Stocks That Matter | Henry Ellenbogen Interview (12/16/25)

TLDR:

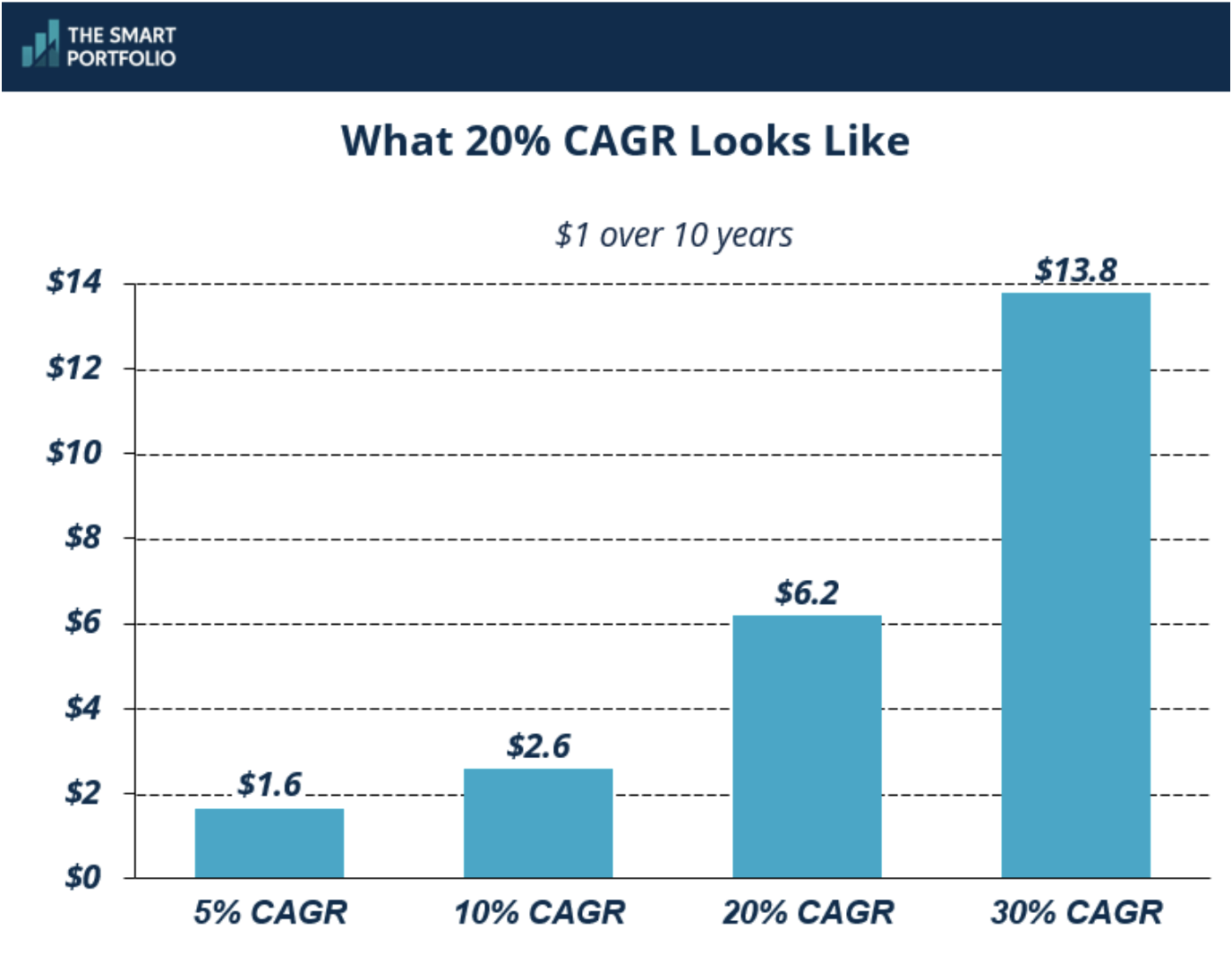

Only about 40 stocks (1% of the market) compound at 20%+ annually over rolling 10-year periods – the key is identifying them

"Act Two" entrepreneurs – founders doing it again with pattern recognition from prior success – have significantly higher odds

80% of these compounders start as small caps, making early identification crucial

Henry Ellenbogen founded Durable Capital Partners after discovering something striking at T. Rowe Price: only about 20 stocks drove 50 years of performance for their flagship small cap fund. Even more sobering – they sold Walmart early. Had they held, that single position would have exceeded everything else combined.

The 1% framework for portfolio construction

Ellenbogen's research reveals consistent patterns: over any rolling 10-year period, roughly 40 stocks (1% of the market) compound at 20% annually – growing about 6x. These are the "valedictorians." Everything at Durable is designed to maximize the probability of owning them.

Crucially, 80% of these compounders start their journey as small cap companies. This has direct implications for how investors and their advisors think about small cap allocation: not as a style box to fill, but as the hunting ground for future large caps.

Why Act Two entrepreneurs outperform

Ellenbogen's highest-conviction investments often involve founders doing it again. When he backed Workday, co-founders Aneel Bhusri and Dave Duffield had already built PeopleSoft. They understood exception management, enterprise sales cycles, and scaling challenges that first-time founders learn painfully.

Max Levchin (PayPal co-founder, now at Affirm), the Duolingo team, Figma's Dylan Field – pattern after pattern shows that founders with prior success bring advantages that compound: they recruit better, structure organizations smarter, and navigate challenges with experience.

The "good to great" thesis for existing companies

Not all compounders are disruptors. Domino's Pizza was the best Russell 2000 growth stock of the 2010s. Not through explosive growth but by using technology to win convenience while competitors stagnated. Walmart and Costco didn't get disrupted by Amazon; they adapted and captured 62% of retail alongside it.

For investors and advisors, this means looking beyond pure technology for AI beneficiaries. Which existing businesses with scale advantages will use new tools to accelerate their dominance?

The bottom line

The math of compounding is brutal: missing the 1% that matter can devastate long-term results, while finding them creates generational wealth. This framework suggests concentrating attention on identifying management teams positioned in growing markets with durable advantages. The valedictorians exist; the challenge is recognizing them early.

Disclaimer

This newsletter is for informational and educational purposes only and should not be construed as personalized financial, tax, legal, or investment advice. The strategies and opinions discussed may not be suitable for your individual circumstances. Always consult a qualified financial advisor, tax professional, or attorney before making any decisions that could affect your finances. While we strive for accuracy, we make no representations or warranties about the completeness or reliability of the information provided. Past performance is not indicative of future results. All investments involve risk, including the possible loss of principal. The publisher, authors, and affiliated parties expressly disclaim any liability for actions taken or not taken based on the contents of this publication.