Why Alternatives Are Now Mandatory, Not Optional

IRRs are lying to you... How do you compare an oil deal against a private credit deal? There's no common yardstick so the "best" opportunity often wins on headline IRR. We're building something to fix this: a standardized "Return per Unit of Risk" score that lets you compare public investments against private deals. If you want early access, reply "COMPARE" or check out dealdx.co (currently onboarding 10 ‘design partners’)

In this issue:

New Feature: Quick Takeaways

Private credit: a smarter income alternative?

How being average can make you a top performer

JP Morgan’s forecast: why alternatives are no longer optional

1. Quick Takeaways

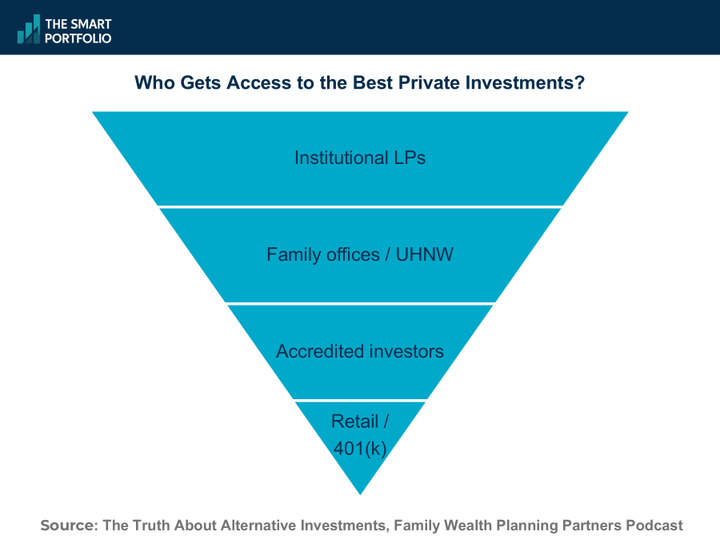

The airplane boarding analogy: why PE should never go in your 401(k). Think about boarding a plane. First class boards first, takes the best seats. By the time Zone 7 boards, everything good is gone. Private equity works the same way. The best deals go to investors with the most capital. They don't want more investors diluting their ownership. By the time an opportunity reaches retail 401(k)s, it's been passed over by everyone with real money.

Source: The Truth About Alternative Investments, Family Wealth Planning Partners podcast (12/8/25)

Industrial real estate is the only commercial sector with positive three-year returns. While office, retail, and multifamily have struggled since the pandemic, industrial has thrived. The reason? E-commerce requires massive logistics infrastructure – warehouses, distribution centers, and storage facilities form the backbone of online shopping. Add in the AI boom driving unprecedented demand for data centers, and you have a supply-demand imbalance pushing both rents and property values higher.

Source: Breaking Down a Real Estate Deal, Vincent Private Markets podcast (12/10/25)

GP stakes offer cash flow from day one with compounding upside. GP stakes investing means buying equity in asset management firms themselves: you get immediate cash flow from management fees (1-2% of AUM) plus upside from carried interest and AUM growth. Owning the fee stream itself may be the smartest way to participate in private equity. Capricorn Investment Group’s example: they invested in an asset manager with $50 million AUM that now manages $50 billion.

Source: “Are GP Stakes the Wagyu of Private Capital?” The Future Investment Initiative Institute (FII) conference session (12/9/25)

A new playbook for oil & gas deals: drill and sell. Traditional oil and gas investing follows a risky pattern: find a promising location, drill a well, and hope you hit. Jay Young, a fourth-generation oilman and CEO of King Operating Corporation, estimates that 70-80% of investors in these one-off deals never get their money back. The new school approach looks more like real estate development: acquire large acreage positions with 200+ potential drilling locations, drill 10-20% of those locations to prove production and generate cash flow, sell the entire package to a public company that pays a premium for the remaining 180 undeveloped locations. The public company can finance the acquisition through Wall Street, and private investors capture a multiple on their capital rather than praying a single well hits.

Source: Top 2026 Strategies for Oil and Gas Investing, Investing Secrets podcast (12/11/25)

2. Private credit: a smarter income alternative?

Evaluating Smarter Income Alternatives webinar with Ellis Hammond of Aspen Funds (12/8/25)

TLDR:

Private credit funds can deploy capital by taking preferred equity positions in real estate projects – sitting behind senior debt but ahead of the sponsor's common equity, which provides a 15-25% "first loss" cushion.

Preferred equity positions can provide meaningful tax efficiency through two mechanisms: deferral (pushing taxes to exit) and rate arbitrage (converting 37% ordinary income to 25% depreciation recapture), worth approximately 19-24% in tax savings.

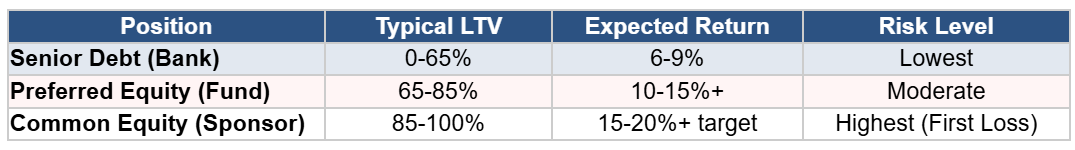

The capital stack: who gets paid first

Think of the capital stack as a hierarchy of claims on an asset, organized by payment priority. At the top sits senior debt – first-position secured lending, typically from banks. These investors have the highest priority: they get paid first in any scenario, which means lower risk and lower returns (typically 6-9%).

Move down the stack and you're accepting lower payment priority (more risk) in exchange for higher yields:

The key insight: common equity is the "first loss" position. Before the preferred equity loses a dollar, the sponsor's common equity must be completely wiped out. This creates a cushion – typically 15-25% of property value – protecting the preferred equity investor.

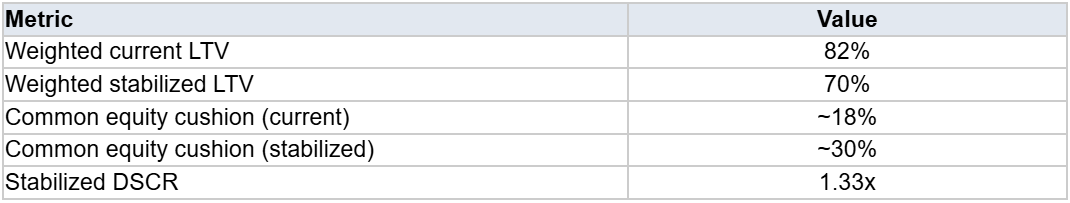

Quantifying the risk: what would need to happen for losses

Using Aspen's private credit fund as an example, Hammond shared these metrics for their preferred equity positions:

Current value = What the property is worth today, in its present condition

Stabilized value = What the property is projected to be worth once the sponsor executes their business plan (renovations complete, occupancy increased, rents raised to market levels, etc.)

What this means in practice: For the preferred equity to take a loss, property values would need to decline by more than 18-30% (depending on current vs. stabilized values), wiping out the common equity cushion entirely.

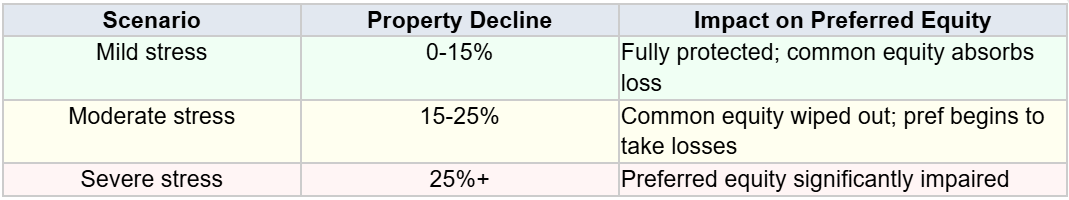

Stress scenario analysis:

The tax efficiency angle: two sources of benefit

Traditional debt fund investments generate ordinary interest income, taxed at the marginal rate (up to 37%). But preferred equity positions in real estate-focused private credit funds can offer meaningful tax advantages through two distinct mechanisms:

1. Tax deferral through depreciation pass-through

When a private credit fund takes a preferred equity position (rather than making a loan), it becomes an equity holder in the underlying real estate – even though it functions like debt economically. As an equity holder, the fund receives depreciation allocations from the property, which it passes through to investors on their K-1s. This depreciation can offset the income you're receiving, deferring your tax bill to exit.

2. Tax-rate arbitrage at exit

When the investment exits, depreciation that offset income during the hold period is "recaptured" as taxable gain. But here's the arbitrage: that recapture is taxed at a maximum rate of 25% (Section 1250 unrecaptured gain), not your ordinary income rate of up to 37%. That's a 12 percentage point spread for top-bracket investors.

Worked example: quantifying the tax benefit

Let's compare a traditional debt fund versus a private credit fund using preferred equity:

Assumptions:

$100,000 investment

10.5% annual cash yield ($10,500/year)

Depreciation: $20,000 in Year 1 (front-loaded), then $5,000/year in Years 2-5

5-year hold, return of principal at exit

Investor in 37% federal bracket; 25% recapture rate

No other passive income to absorb excess losses

Scenario A: Traditional Debt Fund

Each year, the investor receives $10,500 in interest income, taxed at 37%:

Annual tax: $10,500 × 37% = $3,885

Total tax over 5 years: $19,425

Scenario B: Private Credit Fund (Preferred Equity)

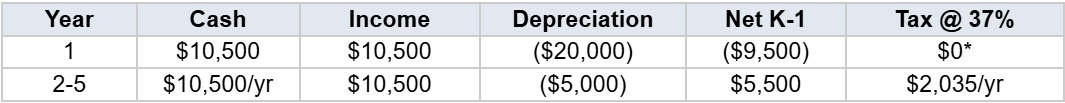

Year-by-year tax calculation:

*Year 1: $20,000 depreciation first offsets $10,500 income (tax = $0). The remaining $9,500 becomes a suspended passive loss – it cannot be used against W-2 income, but it's carried forward to exit.

Tax paid during hold: $8,140 ($0 in Year 1 + $2,035 × 4 years)

Suspended loss carried forward: $9,500

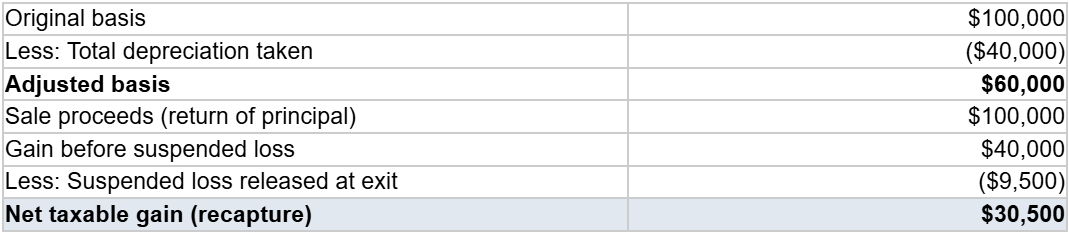

What happens at exit:

Tax at exit: $30,500 × 25% = $7,625

Key insight on the suspended loss: The $9,500 of "excess" depreciation (above the income it offset in Year 1) was never used to reduce taxes during the hold so it's not subject to recapture. Instead, it's released at exit to offset the gain. The investor gets a deduction at the 25% rate without ever having received a tax benefit that would trigger recapture.

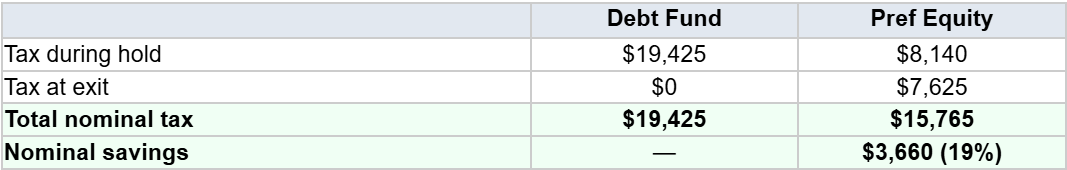

Final comparison

Time value of deferral: Pushing $7,625 of tax to Year 5 instead of paying $3,885/year provides additional present value benefit. At a 5% discount rate, the PV of taxes falls from $16,823 (Scenario A) to $12,852 (Scenario B), a 24% reduction in PV terms.

Bonus for investors with other passive income: If the investor has K-1 income from other real estate partnerships, the $9,500 Year 1 suspended loss could offset that income immediately.

3. How being average can make you a top performer

Avoid Disaster w/ Superinvestor Howard Marks, Richer, Wiser, Happier podcast (12/13/25)

TLDR:

A pension fund ranked between 27th and 47th percentile for 14 straight years, yet finished in the 4th percentile overall because avoiding disasters beats chasing wins.

Investing success comes from "steady excellence" and consistently avoiding losers, not shooting for the stars.

Howard Marks, co-founder of Oaktree Capital Management with $218 billion in assets, recently sat down for a conversation marking 35 years of his legendary investment memos. The core insight? A dinner in Minneapolis in 1990 changed everything.

The dinner that launched a philosophy

David VanBenschoten ran the General Mills pension fund for 14 years. His equity portfolio never ranked above the 27th percentile or below the 47th – solidly second quartile every single year. Yet over 14 years, the fund ranked in the 4th percentile overall.

How is that possible? Most investors swing for the fences and occasionally blow up their records. One catastrophic year wipes out years of gains. Van Bencotton's consistency – avoiding disasters – compounded into extraordinary results.

Why bond investing is a "negative art"

Marks references Graham and Dodd's insight from 1940: if 100 bonds all pay 8%, and 90 will pay while 10 default, it doesn't matter which 90 you buy – they all return 8%. The only thing that matters is excluding the 10 that default. Success comes from what you exclude, not what you include.

This became Oaktree's motto: "If you can avoid the losers, the winners will take care of themselves."

Investing is like playing amateur tennis

Professional tennis players must hit winners because their opponents can return mild shots. But amateurs win by simply returning the ball 10 times – eventually, the opponent makes an error. Investing is more like amateur tennis. There's too much randomness and uncertainty to have control. Swinging for fences gets you carried out.

The bottom line

For advisors counseling clients tempted to chase hot returns: consistent second-quartile performance beats occasional brilliance followed by disaster. Build portfolios focused on exclusion – avoiding the worst outcomes – and the winners will handle themselves. That's how you end up in the 4th percentile over time.

4. JP Morgan’s forecast: why alternatives are no longer optional

The 2026 Long-Term Capital Market Assumptions: Challenges and opportunities, Alternative Realities podcast (12/12/25)

TLDR:

JP Morgan's annual return forecasts drive roughly $1 trillion in investment decisions.

Despite slower expected US economic growth, stocks should still return 6.7% annually because companies are becoming more profitable.

Alternatives now belong in every portfolio, but as more money floods in, picking the right manager matters more than ever.

Every year, more than 100 people at JP Morgan spend 9,000 hours building one document: their Long-Term Capital Market Assumptions. It forecasts what 200 different asset classes will return over the next 10-15 years. Roughly $1 trillion in portfolios rely on these numbers.

The economy will slow, but stocks won't suffer as much as you'd think

JP Morgan lowered their US economic growth forecast to 1.8% annually – down from 2% – largely because they expect almost no growth in the labor force over the next decade.

But they kept their US stock market return forecast steady at 6.7%.

Why? Companies have gotten better at making money. Profit margins are more resilient. AI is starting to boost productivity. JP Morgan raised their corporate earnings forecast by more than a full percentage point over the past two years.

The catch: today's high stock valuations will create drag. They estimate about 2% annual headwind from prices coming back down to earth. In plain terms, expect at least one 20%+ correction somewhere in the next decade.

Bonds are finally worth owning again

For years, advisors struggled to make a case for bonds. That's changed.

JP Morgan's forecast for 10-year Treasuries hit 4.6% – the highest since the 2008 financial crisis. Higher starting yields plus steeper yield curves (reflecting increased risk from government spending) power that number.

Alternatives have become essential, not optional

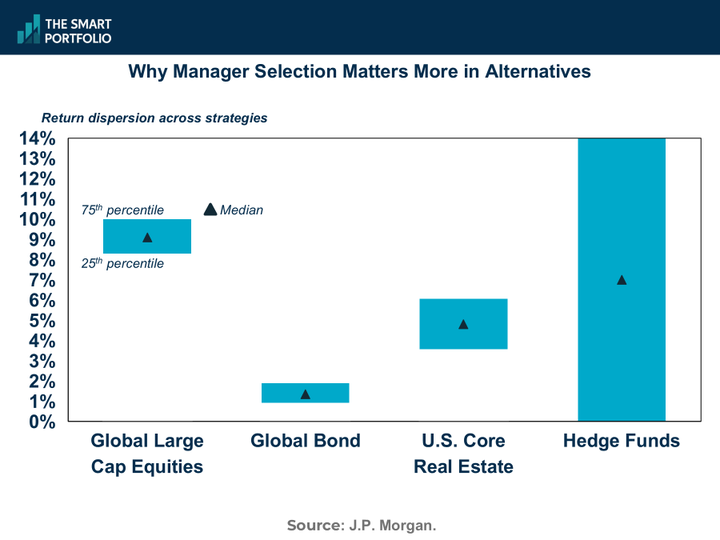

Real estate, private equity, hedge funds – JP Morgan raised forecasts across the board. US core real estate now projects 8.2% returns. Private equity expectations increased too.

But here's the insight that matters most: as billions pour into alternative investments, returns won't necessarily shrink. Instead, the gap between good managers and bad managers will widen dramatically.

The best managers will still deliver. But mediocre managers, competing for deals with all that new capital, will underperform.

Translation: manager selection just became your most important job.

Disclaimer

This newsletter is for informational and educational purposes only and should not be construed as personalized financial, tax, legal, or investment advice. The strategies and opinions discussed may not be suitable for your individual circumstances. Always consult a qualified financial advisor, tax professional, or attorney before making any decisions that could affect your finances. While we strive for accuracy, we make no representations or warranties about the completeness or reliability of the information provided. Past performance is not indicative of future results. All investments involve risk, including the possible loss of principal. The publisher, authors, and affiliated parties expressly disclaim any liability for actions taken or not taken based on the contents of this publication.